Life can throw some nasty curveballs – a job loss, medical emergency, divorce, or other financial crisis – and suddenly you’re behind on mortgage payments. It’s natural to feel overwhelmed or even paralyzed when the past-due notices start piling up. Many homeowners in this situation wonder, “Can I sell my house if it’s in foreclosure, or is it too late?” The good news is yes – you can sell a house that’s in foreclosure or headed there, and in many cases selling is the best way to avoid the worst outcomes. However, time is of the essence. In California (and especially high-priced markets like Los Angeles), acting quickly can mean the difference between salvaging your equity or losing your home with nothing to show for it.

In this guide, we’ll explain how the foreclosure process works in California, what your options are at each stage (including selling your home before or even during foreclosure), and how to go about selling to avoid foreclosure. We’ll also cover key questions homeowners ask, like whether you still owe the bank after a foreclosure and what happens if you do nothing. Our goal is to provide a straightforward, empathetic game plan to help you avoid foreclosure by selling your house on your own terms.

Los Angeles-specific insight: California’s foreclosure laws and timelines have some unique features to protect homeowners, but they also mean you can’t afford to wait too long. We’ll highlight those local details so you know what to expect. By the end of this post, you’ll have a clearer understanding of your options and a plan of action – plus a path to get help right now if you need it.

Let’s dive in with the basics of foreclosure in California and why selling your home before foreclosure (or as early in the process as possible) is often the smartest move.

Understanding the Foreclosure Process in California (Timeline and Key Steps)

Before deciding your next move, it helps to know how foreclosure works in California, especially in Los Angeles. Foreclosure is the legal process a lender uses to take back a property when the borrower stops making payments. California primarily uses a nonjudicial foreclosure process, which means it happens outside of court and can move relatively quickly compared to some states. Here are the key stages and timeline of a typical California foreclosure:

Illustration: Simplified overview of California’s foreclosure process. After a borrower defaults, the lender records a Notice of Default (Step 1), then a Notice of Trustee’s Sale (Step 2) to set an auction date (the foreclosure sale). The auction (Step 3) results in either the sale being postponed, the property being sold to the bank (if no higher bidder), sold to a third-party bidder, or the process being canceled (if the owner resolves the default). After the auction, a Trustee’s Deed transfers ownership to the winning bidder. California’s nonjudicial process has no court hearings, and there is no redemption period after the auction – once it’s sold, the original owner can’t reclaim the property by paying off the debt.

- Missed Payments / Pre-Foreclosure: After you miss a payment or two, the lender will start contacting you (calls, letters) to remind you of the delinquency. Many loans have a built-in grace period, but generally by 90 days of non-payment you’re officially in default. Federal regulations usually require lenders to wait at least 120 days (about 4 months) after the first missed payment before initiating foreclosure. During this pre-foreclosure phase, you still own the home and can sell it normally (this period is often your best opportunity to sell – more on that later).

- Notice of Default (NOD): Once that waiting period passes (usually around 3–4 months of missed payments), the lender can record a Notice of Default in the county records to officially start the foreclosure. In California, the NOD is a public notice that you’re in default on the mortgage. The lender must mail you a copy and often will post it on your property. From the date the NOD is filed, you typically have 90 days to “cure” the default by paying the overdue amount plus allowable fees. This 90-day window is essentially a grace period to catch up – during which no foreclosure sale can happen. You still have the right to sell your home during this period as well (and it’s still considered “pre-foreclosure”).

- Notice of Trustee’s Sale (NOTS): If the 90 days pass and you haven’t paid the required amount to reinstate the loan, the lender can proceed to schedule a foreclosure sale. They will record a Notice of Trustee’s Sale, which sets an auction date for your property. In California, the notice must be given at least 20 days before the auction date. The NOTS will state the date, time, and location of the sale (often on the courthouse steps or online auction). You will be notified via mail and a posting on the property. Up until five business days before the sale, you still have the right to reinstate the loan by paying the back amount plus costs – after that point, to stop the sale you’d likely have to pay off the entire loan balance. Importantly, even in this stage you can still sell your house, as long as you close the sale before the auction date (or negotiate with the bank for a short postponement if a sale is pending).

- Foreclosure Auction (Trustee’s Sale): On the scheduled date, the property will be auctioned to the highest bidder (often an investor or even the bank itself if no one bids higher). If a third-party buys it, they’ll own the house. If nobody bids at least the loan amount, typically it reverts to the lender (“sold back to bank”) and the bank will then own the home (it becomes an REO property). Once the hammer drops at the auction, you no longer own the home. There is no post-sale redemption period in California’s nonjudicial foreclosure process, meaning you generally cannot buy your house back from the bank after foreclosure – the foreclosure is final. (Some other states have redemption periods where you could reclaim the property by paying everything within a certain time, but California does not offer that safety net for nonjudicial foreclosures.)

- Eviction (Post-Foreclosure): If the home is sold at auction (to a new owner or the bank), you’ll eventually have to move out. In California, once the new owner is on title, they must serve you with a Notice to Quit (often 3 days) demanding you vacate. If you don’t leave, they can file an unlawful detainer (eviction lawsuit) to have you removed. This court process takes a few weeks (or longer if you contest it). Ultimately, if you still remain after the court orders eviction, a sheriff will perform a lockout. Bottom line: after a foreclosure sale in Los Angeles, you may have as little as 3 days to leave (plus the time for an eviction proceeding). It’s not like the movies where sheriffs show up the day of the auction to drag you out in handcuffs – you will get a short grace period and a legal process – but it’s a fast process. It’s far better to sell your home before it reaches this stage so you can control your move-out timeline and potentially keep some money from the sale.

Why this timeline matters: As you can see, foreclosure in California can move quickly once it starts. In an ideal scenario, you take action during the early “pre-foreclosure” period, before or immediately after the Notice of Default. The longer you wait, the fewer options you have. Some states (like New York or Hawaii) have extremely long foreclosure timelines (often over 2–5 years to complete), but California is not so slow – a nonjudicial foreclosure here might take only around 4-5 months from the NOD to the auction if everything goes by the minimum timelines. (In practice, banks sometimes delay auctions, and homeowners may get extensions or try loss mitigation, so it can take longer – but you cannot count on a big delay.) The main takeaway is don’t ignore the problem. The clock starts ticking with that first missed payment, and each passing week limits your choices.

Now that we’ve covered the process, let’s answer the core question: Can you sell your home to avoid foreclosure? And if so, when and how should you do it?

Yes, You Can Sell a House in Foreclosure — and You Probably Should

The simple answer to “Can I sell my home if it is in foreclosure?” is YES. In fact, selling the home is often the best way to avoid foreclosure and its more dire consequences. However, when you sell in the timeline makes a big difference. Let’s break it down by stage:

Selling During Pre-Foreclosure (Before the Auction)

If you’re behind on payments but the house hasn’t been sold at auction yet, you are effectively in “pre-foreclosure.” This is the period after you’ve defaulted but before the foreclosure sale takes place. During pre-foreclosure, you absolutely can sell your house – you still hold the title. In California, you even retain the right to sell up until the auction actually happens. Selling before the foreclosure is completed is commonly called a pre-foreclosure sale (or sometimes a short sale if the sale price won’t fully pay off the loan – more on that later).

Advantages of selling your house before foreclosure (early in the process):

- You avoid a foreclosure on your credit record. If you sell the home and pay off the mortgage (or even negotiate a short payoff), the foreclosure process stops. This prevents that damaging foreclosure mark from hitting your credit report. A foreclosure can knock 100+ points off your credit score and stay there for 7 years, impacting your ability to buy another home or even rent. A pre-foreclosure sale is far better for your financial future.

- You get to keep any equity (ownership stake) you’ve built. Home prices in Los Angeles have risen a lot in recent years, so you might have equity even if you’re behind on payments. By selling at market value, you can pay off the loan and keep the remaining cash. This could be money for a fresh start (renting a new place, paying off other debts, etc.). If you instead let the house go to auction, the bank or a third-party buyer could end up with all that equity. (Many homeowners are shocked to learn that if their house sells for more than they owe at auction, they don’t automatically get that full difference – fees and legal costs get subtracted, and any leftover might be tied up or even require legal action to claim. It’s risky.) Selling it yourself ensures you maximize what you get out of your home.

- You have more control over the sale and moving timeline. During pre-foreclosure, you can list your home, pick a buyer, and negotiate a closing date that works for you (within the limits of the foreclosure timeline). You’re selling on your terms, not the bank’s. This means you can avoid the frantic, last-minute scramble of an auction or eviction. For example, you might negotiate a slightly longer closing or even a short rent-back after closing (where you stay in the home for a couple weeks) to have time to move in an orderly way.

- You can take time (if you have it) to prepare and get a better price. If you start early in pre-foreclosure, you might have a month or two to make minor repairs, clean, or even stage the home for sale to attract regular buyers. This way you’re not just dumping the property at a bargain price – you can sell for full market value, especially in a strong market like California. You also have the option to hire a real estate agent to help you market and sell the home for top dollar. (Many top agents have experience with pre-foreclosure sales and can be a huge asset – they’ll handle pricing, marketing, and dealing with the bank’s requirements once you get an offer.)

In short, the earlier you decide to sell, the better the outcome is likely to be. As Bethany Mendoza, a top real estate agent in California who’s helped clients avoid foreclosure, puts it: “Don’t wait until your foreclosure sale is just 30 days away. That’s what homeowners typically do because they’re in denial, and it puts you in a dire situation where you have to sell aggressively and leave money on the table.” Take it from professionals – waiting too long can cost you equity.

Los Angeles Homeowner Example: One homeowner in California had a house worth over $500,000 and fell behind on a relatively small portion of their loan (about $10,000). They ignored the problem until it was almost too late, leaving only 60 days before the foreclosure sale for an agent to sell it. The home did sell, but the owner walked away with far less than if they had listed it earlier. The lesson? Even high-value homes can and will be foreclosed on for minor delinquencies – and if you wait, you might fire-sell your house for less. Start the sale process as soon as you know you’re in trouble.

Selling After a Foreclosure Notice (During the Foreclosure Process)

What if you’ve already received a Notice of Default or a foreclosure auction date? Can you still sell your home during foreclosure? Yes, you can. Even if your home is officially “in foreclosure,” you retain the right to sell it up until the auction actually occurs. This means that even after the lender starts foreclosure proceedings, you can list your house for sale or accept a buyer’s offer. In fact, many buyers (especially real estate investors and cash buyers) specifically look for pre-foreclosure homes to purchase, and they can close quickly. The key challenge once you’re in this stage is time – you may only have a few weeks or a couple of months before the scheduled auction, so you need to move fast and be decisive.

Here are some important considerations if you’re trying to sell your house during foreclosure:

- Let your lender know you’re selling. Believe it or not, most lenders would prefer you sell the property and pay them off rather than go through with a foreclosure sale. Foreclosures cost the bank money and they end up owning a house (banks don’t like owning real estate). If you inform the bank that you have the home listed or have an offer, they may be willing to postpone the auction. In California, under the Homeowner Bill of Rights, if you have a bona fide offer from a qualified buyer, the bank cannot foreclose on the home – they must pause the process to allow the sale to close. Lenders are even required to give you an extra 30 days if you’re in contract with a buyer. This is huge – it means as long as you find a buyer in time, you can likely avoid the foreclosure completing. So keep the lines of communication open with your lender’s foreclosure department; let them know your plan. (We’ll talk more about staying in touch with the bank in the steps section below.)

- Consider a quick sale (cash buyer) if needed. If your auction date is uncomfortably close, listing your home on the market at a normal price might not yield a buyer in time. In such cases, selling to a cash home buyer or real estate investor can be a smart strategy. Cash buyers (like home-buying companies or individuals who advertise “we buy houses” or teams like MaxNet Homes in Los Angeles) can often make you an offer within days and close in as fast as 1-2 weeks, since there’s no mortgage process to slow things down. You might not get full market value from an investor – they often pay a bit less in exchange for speed and buying “as-is” – but if the alternative is losing the house altogether, it may be worth it. Avoiding foreclosure is the priority, and a reputable cash buyer can help you do that with a guaranteed, fast closing. (Tip: Always work with trustworthy, local investors. Look for a company with a strong reputation. Tricia Watts, a Los Angeles real estate investor and head of MaxNet Homes, emphasizes choosing a buyer who is transparent, fair, and has experience in the area. “You want someone who genuinely wants to help you find a solution, not just a quick profit,” she advises.)

- Price your home to sell – and sell fast. When time is short, pricing strategy is critical. You may not have the luxury of holding out for an extra $10,000 if it means the difference between selling in time or not. Study recent sales in your neighborhood and consider pricing at the lower end of the range to attract more buyers quickly. As one expert put it, “You don’t have time to waste when you’re headed into foreclosure. You need to price your home fairly yet competitively. If it’s priced right, it’s going to sell within a week or two.” In a hot market like Los Angeles, that might mean listing just below the nearest round number or a tad under comparable sales to generate immediate interest. Remember, selling fast is the goal – you can’t afford a deal falling through or a buyer who drags their feet.

- You don’t have to broadcast your situation to buyers. Some homeowners worry that if people know the house is in foreclosure, they’ll only get lowball offers. The truth is, you are generally not required to disclose a pending foreclosure to potential buyers. It’s considered a private financial matter, not a material defect of the property. Most regular buyers won’t even know unless they research public records (most don’t). So, you can market your home normally. Only your agent and any investor buyers you directly approach need to know. Keeping it discreet can help you get fair market value offers without the stigma. Of course, if a hard deadline is approaching, your agent might selectively inform any interested buyer’s agent that you need a quick closing (to ensure they can meet the timeline), but the general buying public doesn’t have to know you’re in foreclosure.

- Act decisively and don’t delay. If you already have a foreclosure notice, every day counts. Avoid procrastination or wishful thinking that something will magically change. The sooner you list the home or reach out to investors, the better chance you have to find a buyer in time. It’s emotionally difficult to let go of your home under duress, but remember that selling now is likely better than the alternative (losing the home at auction and getting nothing). Many homeowners who’ve gone through it say that once they decided to sell, a weight was lifted because they regained some control. You’re taking action for yourself, rather than waiting for the bank to act against you.

California-specific tip: Lenders in CA must follow certain steps (like contacting you 30 days before filing NOD, offering ways to avoid foreclosure, etc.), which can buy you a little time. But by the time a Notice of Trustee’s Sale is posted, you’re on a fixed schedule. If you’re in Los Angeles and get a sale date notice, reach out to a local foreclosure specialist immediately – they’ll know how to possibly get that sale postponed or guide you through a lightning-fast sale.

Next, let’s talk about how to actually execute a sale to avoid foreclosure – what steps to take to set yourself up for success.

How to Sell Your Home to Avoid Foreclosure: 5 Key Steps

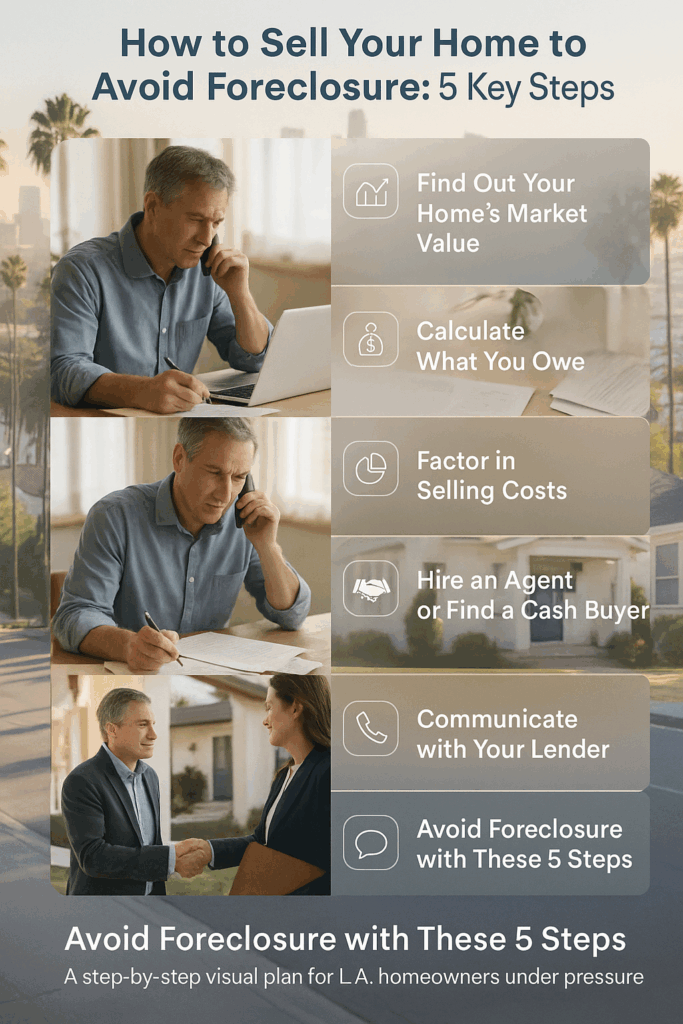

Selling a home under normal circumstances can be stressful enough. Selling under the pressure of foreclosure is even more intense – but it can be done with a clear plan. Here are five key steps to follow if you want to sell your house before foreclosure (or during the foreclosure process) in order to avoid losing it at auction:

1. Find Out Your Home’s Market Value – Start by getting a realistic idea of what your house could sell for in the current market. Use online tools or look at recent sales of similar homes in your area. In Los Angeles, values can change quickly, so current data is important. Consider asking a real estate agent for a comparative market analysis (many will do this for free) or use an online estimator. Knowing your approximate home value will help you determine if a sale will cover what you owe and potentially leave you with cash. (If you’re underwater – owing more than the home is worth – jump ahead to the section on short sales. But if you have equity, a standard sale is the way to go.)

2. Calculate What You Owe (Your Payoff Amount) – Contact your lender (or check your latest mortgage statement) to find out exactly how much it would cost to pay off your mortgage. This likely includes the principal balance, any accrued interest, late fees, and possibly foreclosure attorney fees if the process has started. If you’ve received a reinstatement quote or Demand Letter from the bank, use that figure. Also, if you have any other liens on the property (a second mortgage, HELOC, tax liens, etc.), note those balances too. Add up all the debts secured by the home to get your total payoff. This number will tell you the minimum you’d need from the sale to cover everything. (For example, if your home might sell for around $500,000 and your total mortgage payoff + liens + fees is $450,000, then theoretically you could sell and pay it off, leaving $50,000 before other closing costs. If your debt is more than the home’s value, you’ll be looking at a short sale scenario.)

3. Factor in Selling Costs – Selling a house isn’t free. Even in foreclosure, if you list the home traditionally, you’ll incur some costs like real estate agent commissions (often ~5%–6% of the price, usually paid out of the sale proceeds), escrow and title fees, possibly transfer taxes, etc. If the house needs a little sprucing to show well, you might invest in minor fixes, cleaning, or staging (though if time is short, focus only on essentials). If you’re working with a tight equity margin, you need to account for these costs to avoid surprise. Roughly estimate about 7–8% of the sale price for total selling costs in California (commissions + closing costs). Subtract this from your expected sale price. If you plan to sell to a cash investor, the good news is you can often avoid many of these costs – investors typically buy “as-is” (no repairs or staging) and without agents, meaning no commission. Many cash buyers even cover standard closing fees. However, they might offer a bit less than market value to account for this convenience. Weigh your priorities – speed and certainty versus getting top dollar – and decide which route’s net outcome is better for you.

4. Hire an Experienced Agent or Connect with a Reliable Buyer – This is crucial. Selling a home under distress is not a DIY project for most people. A seasoned real estate agent (Realtor) who has handled pre-foreclosures can be a lifesaver: they’ll price it right, find a buyer quickly, and handle communications with the bank’s foreclosure department to ensure the sale goes through smoothly. If you’re in Los Angeles or Southern California, look for agents who mention short sales or foreclosure assistance in their portfolio. Tricia Watts, for example, is a local real estate professional who specializes in helping distressed homeowners; having an expert like her in your corner means you get guidance tailored to California’s rules and the LA market. (Yes, you might be thinking “Can I afford an agent?” – but remember, their commission comes from the sale proceeds, and a good agent can actually increase those proceeds by securing a better price or navigating a short sale approval.)

If you choose to skip the agent and go directly to a cash buyer or investor, do your homework to find a reputable company. Request a no-obligation offer and compare it against what you’d net in a traditional sale. The goal is to have a qualified buyer lined up as soon as possible, whether that’s through an agent listing or an investor purchase. Time is money here. Avoid dealing with unproven “we buy houses” folks who pressure you or won’t answer your questions – you deserve someone professional and empathetic in this high-stress situation. (MaxNet Homes, led by Tricia Watts, is one example of a family-owned cash home buying team in LA that prides itself on fair, transparent offers – the kind of partner you’d want if you go the investor route.)

5. Communicate with Your Lender and All Parties – Don’t fall into the trap of dodging the bank’s calls or letters. It might be tempting to avoid your lender, but now is the time to keep them fully informed. Call your mortgage lender’s foreclosure department and let them know you are actively working on selling the house. If you’ve hired an agent, you can sign an authorization allowing the agent to speak to the bank on your behalf – this is very helpful because the agent can then update the bank about offers or negotiate postponing the auction if needed. Most lenders prefer a workout over taking the home; if they know a sale is pending, they may hit pause on the foreclosure. In California, as mentioned, if you show proof of an upcoming sale (a signed purchase contract), the lender often must postpone the trustee’s sale to allow it to close. Also ask the lender about any foreclosure alternatives – sometimes they have programs or can offer a bit more time if they see you’re genuinely selling. Finally, make sure you, your agent (if any), the buyer, and the escrow/title company are all on the same page about the timing. You might need to do a faster escrow or take care of paperwork urgently due to the foreclosure timeline. Staying in close contact with everyone involved will ensure nothing falls through the cracks at the last minute.

Following these steps will put you in a strong position to successfully sell your home in foreclosure before the bank takes it. It’s a team effort: you, possibly an agent, the buyer, and the lender’s reps all have to coordinate. But thousands of homeowners do this every year – you’re not alone, and it is very achievable.

Next, let’s briefly discuss a few common scenarios and questions that come up, like stopping foreclosure once it’s begun, whether a short sale might be right for you, and what happens if you do nothing.

Can You Stop the Foreclosure Process Once It Starts?

Yes, you can often stop a foreclosure once it’s started – right up until the final auction day. “Stopping” a foreclosure usually means curing the default by paying what you owe or negotiating a solution with the lender. Here are a few ways foreclosure can be halted or canceled after it’s initiated:

- Reinstating the Loan: This is the most straightforward – you pay the lender all the back payments, late fees, and their legal costs, and bring the loan current. Under California law, you have the right to reinstate the mortgage up until 5 business days before the sale date by paying the delinquent amount (not the full loan balance). Once you do that, the foreclosure is canceled (a Notice of Rescission gets recorded to officially cancel the NOD). Of course, coming up with a large sum is not easy – but sometimes people are able to find funds through family, a retirement account, or other means. Selling the home is effectively another way to reinstate – because at closing, the mortgage gets paid off from the buyer’s money.

- Mortgage Forbearance or Loan Modification: If you can get the bank to approve a loan workout plan, they might pause or stop the foreclosure. For instance, a forbearance agreement could allow you to temporarily make lower payments (or no payments) for a few months while you get back on your feet, and the foreclosure is put on hold. A loan modification might restructure your loan (interest rate reduction, adding missed payments to the balance, etc.) to make it affordable long-term. Under California’s Homeowner Bill of Rights, lenders cannot “dual track” – meaning if you’re in review for a modification, they typically can’t continue with a foreclosure sale. Important: You must apply for these programs early. Don’t wait until the week of the auction to seek a loan mod – at that point, banks are less inclined to stop things. As soon as you know you’re struggling, call your lender and ask about hardship options.

- Deed in Lieu of Foreclosure: This is essentially “selling” your house back to the bank, or rather, giving them the deed and walking away. In a deed-in-lieu, you sign over ownership to the lender voluntarily, and in exchange they cancel the foreclosure. This option saves the bank the trouble of foreclosure and you avoid having a foreclosure on your record. However, it typically means you get no sale proceeds (because you’re not selling on the open market) and you lose whatever equity you had. Banks also have to agree to it – they often only do if there are no other liens on the property and if the foreclosure process is straightforward. Some homeowners choose this route if a sale isn’t working out, but consider it a last resort. As Tricia Watts notes, “A deed in lieu might prevent the public foreclosure, but you’re still losing the home. If you have any equity or any chance to sell to someone else, do that instead so you’re not left with nothing.” Essentially, deed in lieu is better than a completed foreclosure, but not as good as a normal sale or even a short sale.

- Filing Bankruptcy: In some cases, a homeowner will file for Chapter 13 bankruptcy to halt a foreclosure. A bankruptcy filing triggers an “automatic stay” that temporarily stops foreclosure proceedings. Chapter 13 can allow you to catch up on the mortgage over time (as part of a court-approved payment plan). This route can be complex, has long-term credit implications of its own, and usually requires attorney guidance. It can delay the foreclosure (sometimes significantly), but it’s not a permanent fix unless you can make the payments under the bankruptcy plan. This is more of an emergency measure if you need more time to sell or work something out. Always consult a qualified attorney before considering bankruptcy solely to stop foreclosure.

The main point: Until your house is actually sold at auction, you generally have the ability to stop the foreclosure by paying what’s owed or reaching an agreement. Even if the foreclosure auction is tomorrow, you could theoretically show up and pay the full amount due and cancel it (though that’s rare). Realistically, if you’re at the last minute, your best bet might be a quick sale to an investor who can fund immediately, combined with the lender postponing the sale a few days for closing. Lenders will postpone the auction if you show you’re about to pay them – they want to get paid, not own your house.

One more thing: some homeowners ask, “If my house goes into foreclosure, can I ever get it back?” In California, once it’s sold at auction, you do not have a legal right to redeem or buy it back (no redemption period). The only slim chance would be if the bank took the home and hasn’t sold it yet – you could potentially approach the bank to repurchase as an REO sale, but they’ll market it at full value, and you’d have to qualify just like any buyer (not likely feasible if you were struggling to pay the original mortgage). In practical terms, once it’s foreclosed, it’s gone. That’s why taking action before the auction is so critical.

How Long Does it Take to Sell a Home in Foreclosure?

One of the top concerns for sellers in this situation is, “Can I sell my house fast enough before the foreclosure happens?” The time it takes to sell a home that’s in (or facing) foreclosure depends on a few factors:

- Local Market Conditions: In a hot market (like Los Angeles has been in recent years), houses – even those in less-than-perfect shape – can sell in a matter of days or weeks. In a slower market, it might take longer. Currently, if you price competitively, a Southern California home can often go under contract within 1-3 weeks. Foreclosure status itself doesn’t usually scare away buyers as long as the sale process can be handled properly.

- Pricing and Condition: As mentioned earlier, pricing your home right is key to a quick sale. If you price at or slightly below market, you’ll attract more buyers quickly. The condition matters too; a well-maintained home will sell faster than one that needs a lot of work. That said, plenty of investors specifically seek homes that need TLC, so even a fixer-upper can be sold fast – usually to a cash buyer – if priced accordingly. You might not have time or funds for big repairs, so often it’s about finding the right buyer who is okay with “as-is.”

- Selling Method: If you list with an agent and go the traditional route, factor in a typical escrow period of 30 days (though you can aim for faster). So from listing to closing might be, say, 45-60 days in a normal sale. If that’s too slow for your foreclosure timeline, an auction or cash investor sale can compress this – some investor purchases close in 7-14 days. There’s also the option of an “instant sale” platform or iBuyer (some operate in California) which can make an offer online quickly; just watch out for their fees and ensure they can close by your deadline.

The reality is selling a home in foreclosure isn’t inherently slower than any other sale. It’s more about how urgently you need it done. Homes don’t have a foreclosure flag in the MLS that makes them unsellable – many buyers won’t even know. So you’re essentially doing a regular sale but with a ticking clock. If you’ve got a few months, you can likely sell at a good price through the normal process. If you have only a few weeks, you’ll lean towards speed over price (auction, investor, etc.).

Key tip: When negotiating with a buyer, explain your desired closing timeframe upfront. Most buyers who really want the house will accommodate a quicker closing if needed (or at least won’t drag their feet on loan approval, inspections, etc.). You may also choose a buyer who has a pre-approved mortgage or cash over one who seems shaky, even if their offer is slightly higher – reliability is more important when time is short.

One success story: A homeowner in Virginia (not Los Angeles, but the principle applies) worked with an agent who listed the home conservatively priced and got a full-price offer quickly. They sped through closing and even arranged a short rent-back for the seller so he had time to move after getting his sale proceeds. The buyers never even knew foreclosure was looming – and the seller closed the day before the scheduled foreclosure! The home sold for fair market value and the seller saved his credit and equity. It shows that with the right strategy, you can sell even at the last minute if needed.

Is a Short Sale a Good Option for You?

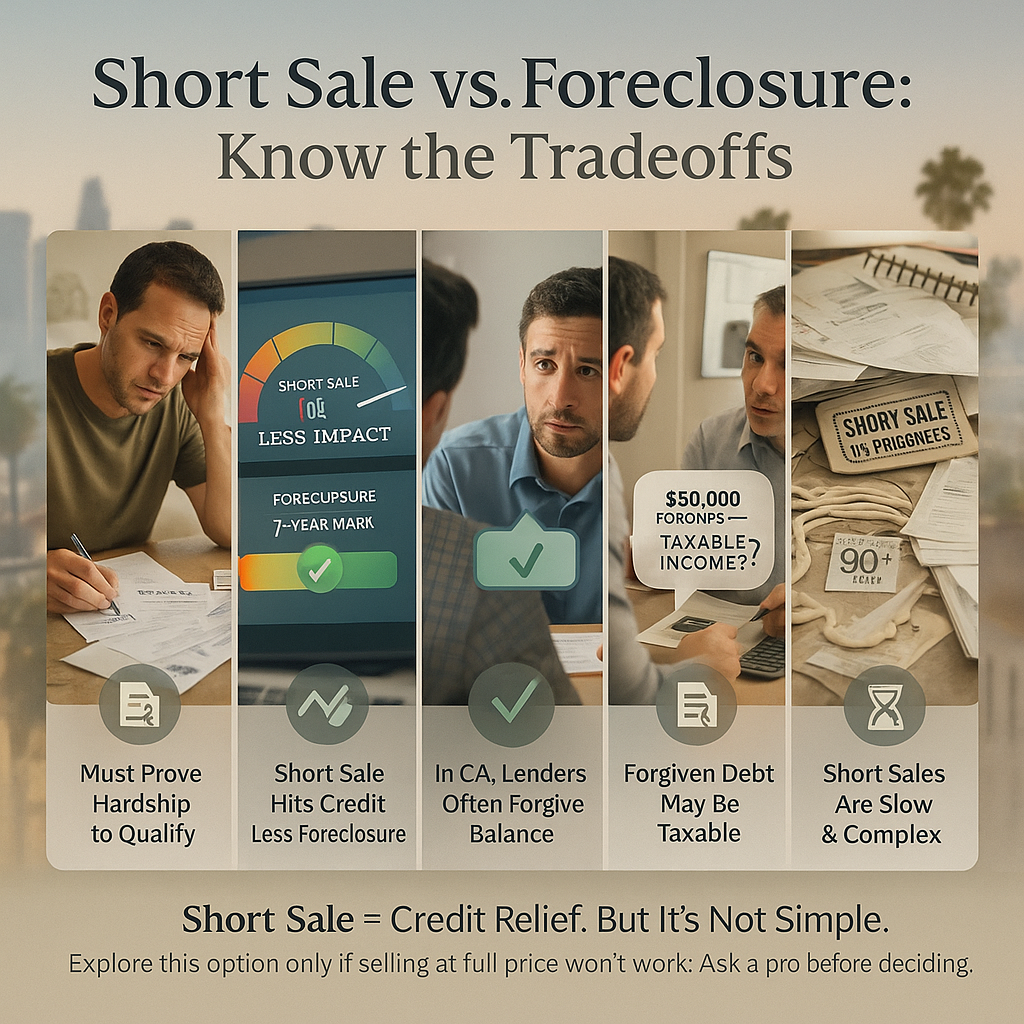

If you owe more on your mortgage than your house is worth – a situation known as being “upside down” or “underwater” on the loan – you might be asking: Can I sell my house for less than I owe? The answer is maybe, through what’s called a short sale. A short sale is when the lender agrees to let you sell the home for whatever price you can get, and they accept that amount as payment, even if it’s not enough to cover the full loan. In a short sale, the bank typically forgives the remaining loan balance (or they reserve the right to pursue you for the difference, depending on the agreement and state law).

Here’s what to consider about short sales in California:

- Eligibility and Approval: You can’t just decide to do a short sale on your own; your lender has to approve it. Generally, to get short sale approval, you need to demonstrate a financial hardship (loss of income, medical bills, etc.) and prove that you have no other assets to pay the difference. The bank will ask for documentation like pay stubs, tax returns, bank statements, etc. They’ll also usually want the house listed on the market to show you’re getting the best offer possible. It’s an involved process and can take some time (often several months from start to finish), because even after you find a buyer, the bank must review and okay the sale price.

- Credit Impact: A short sale will hit your credit, but generally less severely than a foreclosure. On your credit report it might say “Settled for less than owed” or “Paid less than full balance,” which is a derogatory mark but not as devastating as “Foreclosure.” Many people find they can repair their credit and even qualify for a new mortgage sooner after a short sale than after a foreclosure – sometimes in as little as 2-3 years, versus 5-7 years for a foreclosure. As one agent explained, “Your credit will bounce back a lot faster with a short sale on your report rather than if the property is foreclosed on.” Lenders and future creditors also tend to view someone who proactively sold to resolve the debt more favorably than someone who just let the bank foreclose.

- Deficiency Judgment: In some states, after a short sale the lender cannot come after you for the remaining balance (they’re required to forgive it). California generally prohibits deficiency judgments on short sales for residential properties when the lender has approved the short sale – meaning if they agree to the short sale in writing, they can’t later demand you pay the rest. (Always have this in writing in the short sale agreement: that the short sale is accepted as full satisfaction of the loan.) Make sure you discuss this with your agent or attorney during the process. The goal is that after the short sale, you owe nothing further on the mortgage. If your loan is a recourse loan (like a refinanced mortgage or home equity loan), the lender might technically have the ability to pursue the shortfall, but in practice if they approve a short sale, they usually waive that right. Always confirm the terms.

- Tax Consequences: One downside to be aware of: any forgiven mortgage debt in a short sale might be considered taxable income by the IRS. For example, if you owed $600k and the bank accepts $550k from the sale, the $50k forgiven could be seen as income on which you owe taxes. There have been laws in the past that provided relief for primary residences (the Mortgage Forgiveness Debt Relief Act), and California often aligns with those, but tax laws change. Consult a tax advisor to see if you’d owe taxes on the forgiven amount. Sometimes insolvency (if you’re basically broke) can be a defense against that tax. It’s a factor to consider.

- Time and Complexity: Short sales are notoriously not “short.” They often drag on because of all the approvals needed. Buyers sometimes walk away because it takes too long. You also might need a very experienced short sale Realtor to handle the paperwork and negotiations. Also, you may still need to find a buyer willing to stick it out through the process. In a pre-foreclosure situation, if you have equity, a regular sale is way simpler and faster. Short sales are really for when you have no equity and no choice. The bright side is, in 2025, thanks to rising home values, many Los Angeles owners have at least some equity – so true short sales are less common now than they were in, say, 2009. If you’re not sure, crunch the numbers (value minus debt minus closing costs) – you might find you can just break even or better, which means you don’t need a short sale.

In summary, a short sale can be a viable solution to avoid foreclosure if you’re underwater. It’s better on your credit than foreclosure, and you can move on without the house. But it’s also complicated and not guaranteed to succeed (the bank could refuse an offer or demand a higher price). Always attempt a normal sale if possible; reserve short sale for when you genuinely can’t fully pay off the loan.

If you think a short sale is your only route, definitely get a qualified professional to guide you – do not try that alone. There are attorneys and agents who specialize in short sales. Tricia Watts and her team, for example, have experience with these transactions and can help Los Angeles homeowners navigate the bank’s requirements while also finding a buyer. Having an advocate can make the difference between an approved short sale and a foreclosure.

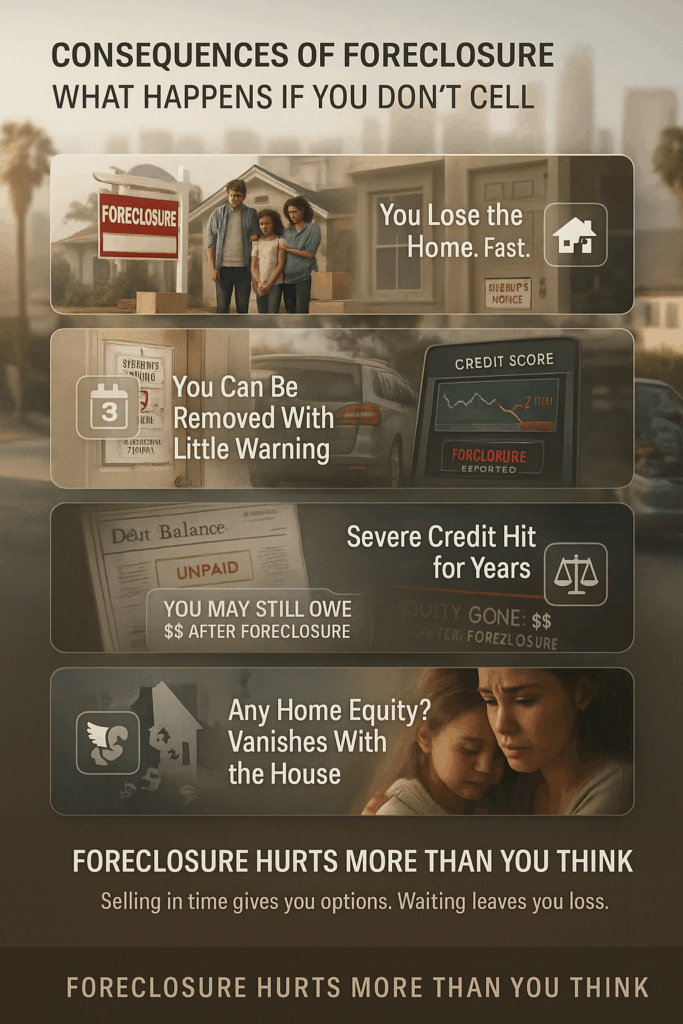

Consequences of Foreclosure: What Happens If You Don’t (or Can’t) Sell

Let’s address the tough scenario: What if foreclosure happens and you weren’t able to sell your home in time? Understanding the consequences can be painful, but it’s important – and it underscores why selling to avoid foreclosure is so critical.

- You lose the house: This goes without saying, but foreclosure means the ownership of the home transfers to someone else (the bank or an auction buyer). You and your family will have to move out, often on short notice. The emotional toll can be heavy – it’s okay to feel sad, angry, or ashamed. But remember, you’re far from alone; many families have been through this. And losing the house doesn’t mean you can’t rebound – many people go on to become homeowners again after some years. It’s a setback, but not the end of your story.

- Eviction Process: After foreclosure, if you’re still in the home, the new owner will initiate eviction (unlawful detainer). As mentioned earlier, in California they only need to give a 3-day notice to quit in most cases. If you don’t leave, the court process might give you a few more weeks, but eventually the sheriff will enforce the eviction. Unlike tenants, former owners in foreclosure don’t typically get the 90-day grace period (there’s a federal law protecting bona fide tenants, but it doesn’t apply to the ex-owner occupying the home). One small consolation: sometimes banks offer “cash for keys,” which is a deal where they pay you a bit of money (perhaps a few thousand dollars) to leave the home in good condition by a certain date. This helps them secure the property faster and gives you funds to relocate. If you’re facing eviction, proactively asking the bank if they offer cash-for-keys might be worthwhile.

- Credit Damage: A completed foreclosure is one of the worst marks on a credit report. It will typically stay on your credit report for seven years. In the first couple of years, it will severely hamper your ability to get new credit at reasonable rates. You may have trouble financing a car, and you will almost certainly have to wait at least a few years to qualify for another mortgage (many lenders require 3-7 years after foreclosure, depending on the loan program). Even things like job applications or apartment rentals can be impacted, since those often ask if you’ve had a foreclosure. The impact does diminish over time, but it’s a long road to rebuild compared to if you avoid foreclosure. By contrast, if you manage to sell before foreclosure (even via short sale), your credit will recover faster, and you won’t have to say you’ve been foreclosed on in those situations. This is a major reason to take action early.

- Deficiency Judgment (Owing Money After Foreclosure): This is a big worry for many: “If my house is foreclosed and the sale price doesn’t cover what I owe, will I still owe the bank money?” The answer in California is possibly, but often no – it depends on the circumstances. California has anti-deficiency laws that generally prevent lenders from pursuing borrowers for a deficiency after a nonjudicial foreclosure on a purchase-money loan (the original mortgage used to buy the home). Most residential foreclosures in CA are nonjudicial, so in many cases the lender can’t come after you for any shortfall – the foreclosure is the end of it. However, if you had refinanced your mortgage or took out a second mortgage/home equity loan, those are not purchase money. A lender could potentially file a lawsuit after foreclosure to get a deficiency judgment for the unpaid balance on those loans. It’s not common, but it’s a risk. Also, if the foreclosure was judicial (rare in CA, but used sometimes for high-value homes or second loans), then the lender could pursue the deficiency through the court judgment. For example, if your home sold at auction for $50,000 less than owed, that $50,000 would be unsecured debt and they might try to collect it like a debt collector would – possibly garnishing wages or placing liens on other property. Again, California homeowners are often protected from this in standard cases, but it’s wise to consult a legal advisor about your specific loan type. In any case, a foreclosure does not necessarily wipe out all your financial obligation unless laws prevent the deficiency or the lender chooses not to pursue it. On the flip side, if the house sells for more than you owed, the excess should go to you, the former owner (after paying off junior liens and costs). However, you’d have to claim that surplus, and sometimes it requires filing with the court or trustee. It’s not an automatic check in the mail. And many foreclosures don’t result in any surplus – houses often sell at auction at or below the loan amount.

- Loss of Equity: We touched on this, but it’s worth emphasizing: any equity you had is basically lost in a foreclosure. If the bank takes the property and later sells it for a profit, that profit doesn’t come back to you. It’s gone. This is why, especially in Los Angeles where home values are high, it’s heartbreaking to see people with $100k, $200k of equity simply lose it to foreclosure. For example, if you bought years ago, you might have substantial equity – don’t let that become the bank’s windfall. Selling the home yourself unlocks that equity for you. As one Realtor recounted about a client: “The seller avoided foreclosure, and he didn’t lose $250,000 of equity that he had in the property. Not only did he get a fresh start; his self-worth was restored.”. That quarter-million would have evaporated if he’d done nothing.

- Emotional and Personal Impact: Beyond the dollars and credit scores, there’s the personal toll. Foreclosure can be emotionally devastating. It can strain marriages, affect kids (having to change houses or schools abruptly), and cause embarrassment or guilt. Many people feel like they failed or that they’ll never recover. It’s important to remember that foreclosure is often caused by external events out of your control – bad things happen to good people. Seeking support from friends, family, or even a counselor can help you process it. Sometimes just having an expert like Tricia or another empathetic professional to talk to can reassure you that you’re making the best of a tough situation. By choosing to sell proactively, you’re taking control and doing something positive – that can be empowering and help offset the negative feelings.

In summary: If you do nothing and let foreclosure happen, the consequences are severe: you lose your home, your credit suffers, and you might even have lingering debt. If you sell your home (or otherwise resolve the default) before the foreclosure completes, you keep control of the outcome. You may walk away with cash, your credit will be in better shape, and you avoid the trauma of a forced eviction. It’s the difference between a difficult but managed transition, and an uncontrolled, damaging one.

Bottom Line: Act Now to Protect Your Home and Future (Don’t Wait!)

Facing foreclosure can be overwhelming – it’s easy to slip into denial or paralysis. But as hard as it is, don’t wait until it’s too late. As soon as you realize “I might not be able to keep up with this mortgage,” start exploring your options. The longer you wait, the fewer choices you’ll have. The fact that you’re reading this shows you’re on the right track and looking for solutions.

Here’s the bottom line: You can avoid foreclosure by selling your home, even if you’re already in default. It’s not too late until the gavel falls at the auction. By selling, you’ll likely preserve your credit score, save your equity, and limit the financial fallout compared to a foreclosure. Most importantly, you’ll be able to move forward on your own terms, with cash in hand and your dignity intact.

Expert reminder: In the current market, many homeowners have more equity than they realize. “In Los Angeles, we’ve found that almost every homeowner we help has some equity,” says Tricia Watts. “Don’t be in denial and just let the house go to foreclosure – that just hands your hard-earned equity back to the bank. If you’re even 60 days behind on payments and you know catching up is unlikely, reach out for help. Get the house on the market or find a buyer, and get as much money out of it as you can.” In other words, take action while you still have time – you may be able to walk away not just debt-free, but with money to start fresh.

Take the Next Step – We’re Here to Help You (Los Angeles Foreclosure Assistance)

If you’re a Los Angeles area homeowner worried about foreclosure, you don’t have to navigate this alone. At MaxNet Homes, we specialize in helping homeowners in tough situations just like yours. Whether you need to sell a distressed property quickly for cash, want guidance on how to list your home before the foreclosure date, or just need someone to explain your foreclosure timeline in California and options in plain language – we’re here for you.

Reach out to Tricia Watts for a compassionate, no-obligation consultation. Tricia is not only a real estate investor with years of experience buying homes in pre-foreclosure, but also a licensed professional who genuinely cares about helping clients find the best solution. She can evaluate your home, discuss your options (sale, short sale, other workouts), and even make you a fair cash offer if a quick sale is your best route. You’ll get honesty, empathy, and zero pressure.

Time is critical when foreclosure is looming. Every day you wait is a day of interest and penalties, and one step closer to that auction. Contact us today and let’s discuss how we can stop the foreclosure and get you on the path to financial recovery. The sooner you reach out, the more solutions we likely have available for you – and even if foreclosure feels inevitable, you might be surprised what can be done with the right expertise.

Don’t lose your home (and equity) without exploring all your options. You owe it to yourself and your family to try every avenue. Selling your home in foreclosure is not easy, but it could be the lifeline that saves your credit and gives you a fresh start. We understand this is a stressful time – our goal is to make the process straightforward and to shoulder as much of that burden as possible for you.

Ready to take the next step? Give Tricia Watts at MaxNet Homes a call or send us a message today. We’ll help you figure out the best plan to avoid foreclosure by selling – on your timeline and to your benefit. Your home may be in foreclosure, but you still have the power to make choices. Let us help you make the choice that leads to a better outcome and a brighter financial future.

Contact Tricia now and let’s get started – the clock is ticking, but there’s still time to turn things around. 🏠💙