Los Angeles’ Trusted Home Buyer: We Buy Houses For Cash! No Repairs. No Commission.

Sell Your House FAST In Los Angeles, CA

Get a Cash Offer From a Local Home Buyer.

Sell As-Is. Pay Zero Fees. Move On Your Timeline. No Repairs, Cleaning, Or Showings.

“Tricia at MaxNet Homes was there whenever we had a question and even handled our loan payoff so the process stayed smooth.

We followed our gut despite warnings, closed in under two weeks, and got paid the next day. So grateful for a fast, stress‑free sale — thanks Tricia and MaxNet Homes.”

– Audrey⭐⭐⭐⭐⭐

MaxNet Homes is a cash home-buying company that treats our customers right. We know that often times, your house is your largest investment, so we want to make sure you get the MaxNet offer for your home! We buy houses in Los Angeles for cash. We are not here to waste your time or make you a lowball cash offer. We are here to help – not to haggle. When you need to sell your house fast, we will give you our MaxNet Offer every time! You will also be treated with respect because we value your time.

With MaxNet Homes, getting a cash offer for your house is 100% FREE. There are never any obligations. So why not see if we are a good fit before locking yourself into a listing agreement with an agent? You’ve got nothing to lose!

You can see Tricia in action on HGTV’s Flipping 101, Season 2, Episode 7 “ Hope the Buyers Have a Dog” – watch as she transforms a distressed property into a beautiful home.

"We were dealing with some family issues and needed to sell my dad’s house quickly. I reached out to Tricia, and she came by that same day! She was knowledgeable, easy to talk to, transparent, and — most importantly — genuinely cared about our situation. Tricia went above and beyond to make the process easy for my elderly father. She checked in on him regularly to see how he was doing, respected his wishes (including leaving his beloved palm trees untouched), and even accompanied him to escrow because she could tell the process felt intimidating to him. She was able to close on our house under 30 days which helped alleviate a huge headache for my dad. I would highly recommend Tricia with MaxNet Homes!"

Trevor Reverditto

An Honest L.A. Home Buyer

When you need to sell your house fast, it’s important to work with a home buying company that is honest and has a track record of treating people fairly.

Meet Tricia, the founder of MaxNet Homes! Tricia started this company with a simple goal – to streamline the process of selling a home, even under tough conditions. What’s most important to Tricia is that she wants to do right by the people she works with because she knows that selling a house can often be stressful.

Tricia has a tremendous knack for problem solving and takes joy in giving sellers the best service possible when buying their home. A fun fact about Tricia, she was featured in the hit HGTV show Flipping 101 with Tarek El Moussa – Season 2.

Benefits of Selling to MaxNet Homes

Get a Competitive, All-Cash Offer Within 24 Hours

When MaxNet Homes buys your house, it’s our goal to make everything as easy as possible for you. Here are the guarantees that you can expect when we buy your Los Angeles house:

Get A Fast Offer In 24 Hours

Once we have your address, we will get straight to work on running our numbers and can have an offer for your home in 24 hours or less. We don’t even need to see your property to make you an offer, we just need to see some pictures of it! That way it saves you time and the hassle.

No Open Houses

When you sell your house with a realtor you’ll have to do an unlimited amount of open houses and showings, so there’s a lot of pressure to have the house looking perfect at all times. But not with us, we just need to see the house once and we don’t even care if it’s dirty!

Pick Your Closing Day

One of the best parts of selling your house to us is that we can give you the certainty of when you need to close by. So whether you want to close next week or in a few months, we can work around your timeline so that closing day happens when you need it to.

No Commissions

When you sell your house to MaxNet Homes, you’ll save thousands of dollars on real estate commissions because we don’t charge you a cent. Plus, we’ll even go the extra mile and pay for all of the closing costs so that you won’t have to pay any fees when we buy your house.

Sell As-Is with No Repairs

Do you want to forget about all of the repairs your house needs and sell it without having to fix anything or even lift a broom? Selling to us means we buy your house as-is, and will never ask you to fix anything before we buy it. Making the sale completely hassle free!

Company That Buys Houses in Los Angeles, CA

We buy houses as-is in Los Angeles, CA, no matter what condition! That means you don’t need to lift a finger or spend unnecessary cash to sell your house. We buy houses as-is in Los Angeles to fix and then eventually resell them. So we are ready to do the work and have teams to handle big projects. You can leave behind whatever you don’t want, and we’ll handle the grunt work!

Choose The Best Way To Sell A House In Los Angeles

Los Angeles homeowners no longer have to settle for a “one option fits all” model for selling a house or rental property. Whether you have the patience to sell your home for top dollar with one of our experienced real estate agents or you would prefer the speed and convenience of a no-obligation, all-cash offer, MaxNet Homes has you covered. We make selling a home easy!

Our “Quick & Convenient Sale” Option:

Sell your house to MaxNet Homes

Sell without the hassles and stress of a traditional listing with our Cash Offer Program.

Competitive cash offer within 24 hours

Tell us about your property, we’ll evaluate it, and provide you with an obligation-free all-cash offer.

No showings, no hassles

You won’t need to disrupt your life with open houses, weekend showings, and non-stop cleaning.

You choose your closing day

Once you accept our cash offer, you won’t wait 30+ days to close. We close on your preferred date.

We’ll cover any repairs

We’ll handle repairs for you and will even haul off unwanted items at no extra charge.

We pay all closing costs

Closing costs can add up. Our cash offers are all-inclusive, which means there are no hidden fees.

No fees or commissions

By buying your house directly from you, we charge no fees and no commissions.

Our “Sell For Top Dollar” Option:

List your house with MaxNet Homes

The preferred option for homeowners who want to maximize their sale price with a traditional home sale.

Maximize your sale price

We’ll sell your house for the highest possible price with our wide buyer network and the best marketing in Los Angeles.

Peace of mind – no matter what

If a buyer’s financing falls through or your circumstances change and you need to move up your timeline, you have more than one option to sell.

Local expertise & knowledge

From setting the right list price to closing without a hitch, you’ll be supported through every step by our Los Angeles real estate experts.

Our Cash Offer is on standby

When you list with MaxNet Homes, you can activate our local Cash Offer Program at absolutely any time.

How It Works

(Yes, it’s really this easy!)

You could have an all-cash offer within 24 hours and close in as little as 7 days. To start, simply tell us about your Los Angeles area house through our easy information form or give us a call at 1 844-MAXNET-8.

STEP 1

Tell us about your Los Angeles house. We’ll get to work analyzing your property.

STEP 2

We make you a competitive cash offer based on the market value and condition of your home.

STEP 3

Choose the selling option that works best for your unique situation.

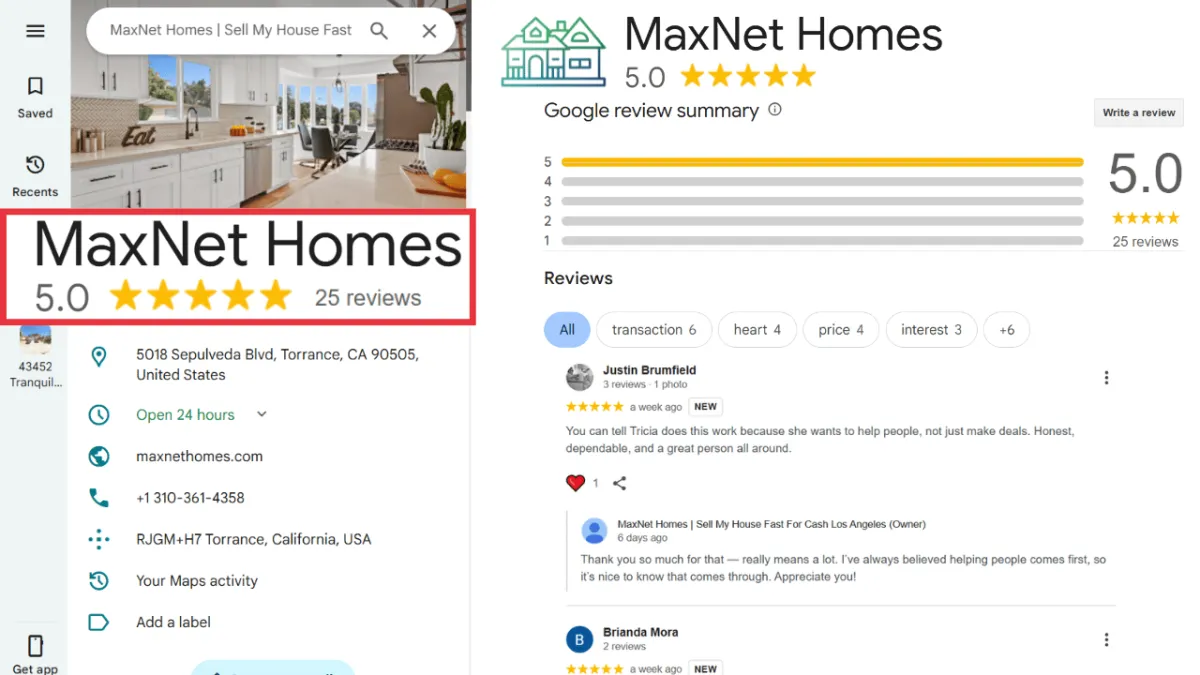

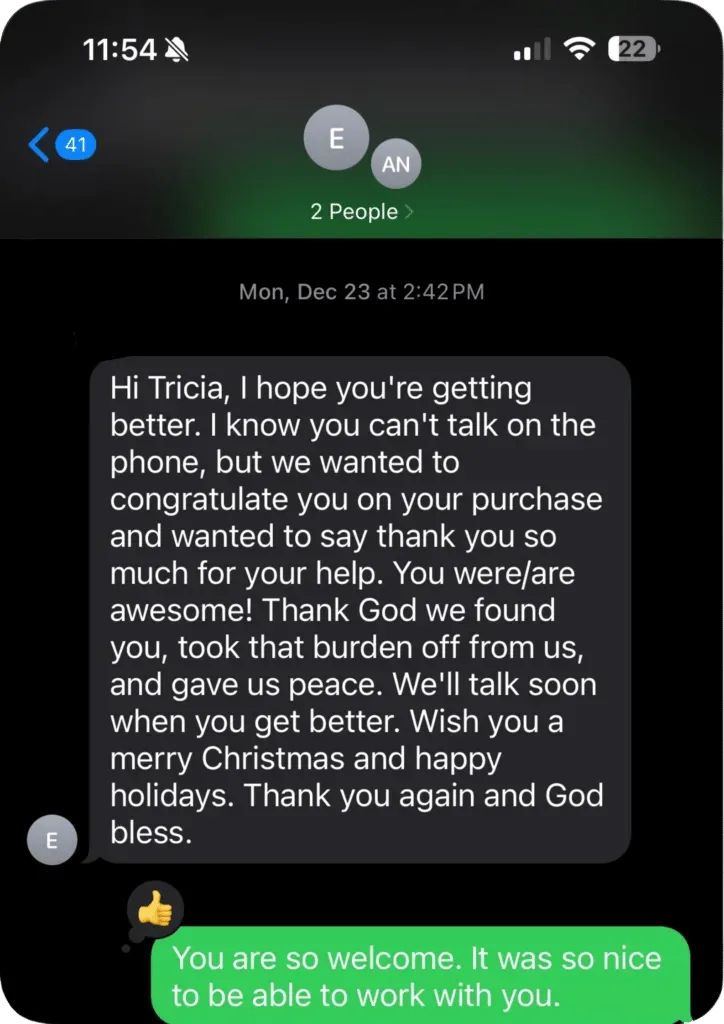

Los Angeles Cash Home Buyer Reviews

See why homeowners across Los Angeles trust MaxNet Homes when they need to sell a house fast for cash.

Our 5-star reviews speak for themselves — real sellers sharing real experiences about smooth, honest, and hassle-free sales.

As one of the most trusted cash home buyers in Los Angeles, we’ve built our reputation on transparency, fair offers, and quick closings.

Before you sell your house to anyone else, take a minute to read what local homeowners are saying about working with MaxNet Homes.

We’re Buying Houses All Over

Southern California

Being professional cash home buyers, MaxNet Homes is the fastest option to sell your house. Don’t own a house in Los Angeles? That’s OK! Dealing in Los Angeles homes is our expertise, and those located in the surrounding cities of Riverside, San Bernardino, San Diego, and Orange County. If you want a fast, hassle-free sale, we’ll make you a competitive cash offer to buy your house. We know the challenges you face when you sell your house and will handle any real estate challenge that comes your way. We promise to treat our Los Angeles customers with kindness and respect. Our service is 100% FREE, and we NEVER charge a commission. Calling us could be the best decision you make today.

Sell My House

Cash California

Sell My House

Cash California

Cash Home

Buyers California

Sell My House Cash California

How Fast Do You Need To Sell Your House In CA?

As CA‘s trusted investment company, as well as licensed and reputable local real estate agents, MaxNet Homes will help you sell your house the best way for your situation.

Some of the ways we work with Los Angeles homeowners include:

• We will list your house on the MLS using our proven proprietary marketing methods to sell your property for top dollar.

• Or, if you want the speed and convenience of an all-cash sale, we will make you a competitive cash offer and close on the date of your choice.

Give us a call today at 1 844-MAXNET-8 and let us know which option works best for you!

Real Stories, Real Relief

Hear from a happy home seller in Buena Park, CA who had an amazing experience working with MaxNet Homes. From start to finish, our team made the process smooth, professional, and stress-free.

Thinking of selling? Let’s make it easy.

📞 Reach out today for a fast, hassle-free cash offer!

We Buy Houses In Los Angeles In ANY Situation

It doesn’t matter whether you live in it, you’re renting it out, it’s vacant, or not even habitable. We help homeowners in CA stuck in difficult situations. You are not alone! Even if you’ve previously listed the property, the house needs repairs you can’t afford, is fire damaged, or has bad rental tenants, MaxNet Homes wants to work with you to find a solution to whatever issue you might be facing. Read more below:

Expensive Repairs

Did your house suffer major damage in the last storm? Do you want to sell but your kitchen needs upgrades that are too expensive for your pocket book?

Problem Inheritance

Did you inherit a property that’s stuck in probate, has back taxes, or is filled to the rafters with trash?

Divorce

Going through a messy divorce and you need to sell as quickly as possible?

Foreclosure

In default on your mortgage or taxes? Is your house scheduled for auction?

Relocating Out Of State

Need to relocate for work or retirement and want a fast and straightforward sale?

Bad Tenants

Sick of being a landlord with tenants and can’t keep up with property upkeep? Tired of the hassle of finding new tenants?

A Faster and Lower Cost Way To Sell Your Los Angeles House

It doesn’t matter whether you live in it, you’re renting it out, it’s vacant, or not even habitable. We help homeowners in CA stuck in difficult situations. You are not alone! Even if you’ve previously listed the property, the house needs repairs you can’t afford, is fire damaged, or has bad rental tenants, MaxNet Homes wants to work with you to find a solution to whatever issue you might be facing. Read more below:

Avoid open houses and daily showings

No closing costs or commissions

No need to pay for a single upgrade or repair.

Already got an offer? Let us try to beat it!

See what we can offer for your house today.

MaxNet Homes makes selling a house in CA fast, easy, and hassle-free! By offering multiple options to sell that traditional Los Angeles real estate agents and cash home buyers can’t offer, we will help you sell your home on a timeline that works for you. Even if your house needs major repairs, we want to purchase it from you as-is. We buy houses in any condition.

Contact us and submit the short property information form (below). We can give you a competitive cash offer in as little as 24 hours and we can close whenever YOU choose to close, or we can figure out the best way to list and market your property to sell for the highest price possible in your neighborhood.

Best of all, because we don’t have to rely on traditional bank financing if you need the cash quickly we can close in as little as 7 days. (Go here to learn about our process →)

Before You List Your Los Angeles House, Get A Competitive Cash Offer From Us!

No matter what condition your house is in; no matter what situation or timeframe you’re facing…

Our goal is to help make your life easier. We want to get you out from under that house or property in CA that’s stressing you out. With our simple Cash Offer Program, we can pay you a competitive and honest price for your house or guide you through the steps to list your home on the market for top dollar. Either way, we’ve got you covered!

Get Your Fast, Competitive Offer Today!

START HERE: We buy houses in ANY CONDITION. Whether you need to sell your home fast for cash or list with a local agent for top dollar, we can help.

Frequently Asked Questions

How much does a house cost in Los Angeles?

Average price: $850,000

Range: Depends on location, size, and condition

Tip: To sell your Los Angeles house fast, you can skip repairs and list with a cash buyer.

Contact MaxNet Homes today for a fast, fair offer.

How much does a house cost in Los Angeles?

Average price: $850,000

Range: Depends on location, size, and condition

Tip: To sell your Los Angeles house fast, you can skip repairs and list with a cash buyer.

Contact MaxNet Homes today for a fast, fair offer.

How do I find the blueprints for my house in Los Angeles County?

Check with Los Angeles County Department of Public Works

Visit your local city’s building and safety office

Ask previous owners or builders if available

No blueprints? No problem — sell your Los Angeles house fast with MaxNet Homes.

Contact MaxNet Homes for a quick cash offer today.

How much is the one house in Los Angeles?

Original list price: $295 million

Final sale price: Around $141 million (2022)

Location: Bel-Air, Los Angeles

Want to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick and fair cash offer today.

How do I find out who owns a house in Los Angeles?

Search Los Angeles County Assessor’s website

Request records from the County Registrar-Recorder’s office

Hire a title company for detailed reports

Need to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick cash offer today.

How do I find out who owns a house in Los Angeles?

Search the Los Angeles County Assessor’s website

Request records from the Registrar-Recorder’s office

Hire a title company for deeper research

Looking to sell your Los Angeles house fast?

Contact MaxNet Homes for a fast cash offer today.

How much do I need to live comfortably in LA?

Estimated income: $75,000 to $100,000 per year

Factors: Rent, transportation, food, healthcare

Housing costs heavily impact your budget

Need to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick cash offer today.

Is it cheaper to buy or build a house in Los Angeles?

Buying is usually cheaper than building

Land, labor, and materials drive up construction costs

Existing homes offer quicker move-in options

Looking to sell your Los Angeles house fast?

Contact MaxNet Homes for a fair cash offer today.

How long does it take to get a building permit in Los Angeles?

Small projects: 2–4 weeks

Large or complex projects: Several months

Factors: Plan check, approvals, zoning reviews

Looking to sell your Los Angeles house fast without the hassle?

Contact MaxNet Homes for a quick cash offer today.

Are LA property records public?

Yes, they are public

Search through the Los Angeles County Registrar-Recorder’s office

Some records are available online for free

Need to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick cash offer today.

Rent-to-Own Home Programs: Legit Pathways to Homeownership in Los Angeles

Are there any legit rent-to-own companies? If you’re an aspiring homebuyer in Los Angeles struggling with a down payment or less-than-perfect credit, you’re not alone. In Southern California’s pricey market, saving up 20% or qualifying for a traditional mortgage can feel daunting. Rent-to-own home programs — also called lease-to-own or lease-purchase programs — offer a creative route to homeownership that many first-time buyers are exploring. These programs let you rent a house with the option to buy it later, allowing time to build equity, improve your credit, and save for a down payment while already living in your future home.

Tricia Watts, a Los Angeles real estate expert and founder of MaxNet Homes, understands the challenges local buyers face. She approaches the topic with a straightforward yet empathetic tone: “Renting can feel like throwing money away, especially in L.A. By guiding clients to legit rent-to-own programs, we help them turn some of that rent into an investment in their future home.” In this guide, we’ll cover the best rent-to-own home programs available today – including Divvy Homes, Home Partners of America, Dream America, and more – and how they work. We’ll also discuss which programs operate in California (and beyond), the pros and cons to watch out for, and tips for Los Angeles buyers. Our goal is to give you unique, original insights on these programs (no fluff or copy-paste), so you can decide if rent-to-own is your best path to homeownership. Let’s dive in!

How Does Rent-to-Own Work?

Before jumping into company reviews, it’s important to understand how to rent-to-own a house. A rent-to-own agreement typically combines a standard lease with an option to purchase the home at a later . Here are the key components of most home lease-purchase programs:

Option Fee (Upfront) – Most rent-to-own contracts require an upfront option fee or initial deposit, usually 1%–5% of the purchase price. This payment secures your right to buy the house in the future and is often credited toward your down payment if you purchase. (For example, Dream America charges about 1% as an onboarding fee at lease , and Divvy Homes asks for 1–2% as an initial “home savings contribution”.) This fee is non-refundable if you choose not to buy, so it’s crucial to enter a rent-to-own agreement seriously committed.

Lease Term & Monthly Payments – You’ll sign a lease and pay monthly rent just like any tenant. However, rent-to-own payments are typically higher than market rent because a portion is set aside as credit toward your future . For instance, Divvy allocates about 25% of each monthly payment to your eventual down payment . Lease terms usually range from 1 to 3 years, though some programs allow up to 5 years. This rental period gives you time to build savings and improve your credit while living in the .

Purchase Price (Locked In) – In most cases, you and the landlord or program agree on a purchase price upfront, before you move . This price may be fixed or increase slightly each year of the lease. Locking in the price can be an advantage in an appreciating market like Los Angeles, since you’ll be able to buy at a pre-set price even if market values . However, if the market declines, you could end up paying more than the home’s future . Be sure the price is fair by comparing recent sales or getting an appraisal.

Purchase Option vs. Obligation – Rent-to-own agreements come in two flavors: lease-option and . A lease-option gives you the choice to buy at the end of the term (you can walk away, though you’d likely lose your option fee and rent credits). A lease-purchase means you’re obligated to buy the home by the end of the lease – a riskier proposition if you’re not 100% sure you’ll qualify for a mortgage by then. Most reputable companies use lease-option models so you’re not forced to buy if circumstances change. Either way, read the contract carefully and consult a real estate attorney if .

Maintenance Responsibilities – Determine who handles upkeep during the lease. Some programs take care of major repairs (since they own the home until you buy), while others pass on maintenance to you as if you’re the owner. For example, Verbhouse covers maintenance while you , whereas other arrangements might make you responsible for everything. Clarify this upfront, because unexpected repair costs can derail your savings plan.

In short, a rent-to-own arrangement lets you test drive the home and neighborhood while working toward . You’ll pay a bit extra for that opportunity (in fees and rent premiums), but for buyers who need time to qualify for a mortgage, it can be a worthwhile trade-off. As Tricia Watts advises, “Understand the terms, but don’t be afraid to explore rent-to-own if it’s the bridge you need to become a homeowner.” Now, let’s look at today’s best rent-to-own home programs and what they offer. We’ll focus on legitimate companies with transparent practices – so you can avoid scams and know you’re dealing with reputable options.

Top Rent-to-Own Companies and Programs (2025)

When it comes to legit rent-to-own companies, a few names rise to the top. Below, we highlight some of the best rent-to-own home programs available, how they work, their pros and cons, and where they operate. These programs are well-known for helping renters transition to owners – essentially serving as companies like Home Partners of America or Divvy Homes that give buyers a second chance. We’ve left out any sketchy operations or ones with a history of scams/excessive fees, focusing only on reputable rent-to-own programs you can trust.

Divvy Homes – Flexible Rent-to-Own for Move-In-Ready Homes

Divvy Homes is often cited as one of the best rent-to-own companies for first-time buyers. Founded in 2017, Divvy’s program is straightforward and user-friendly. Here’s how it works: Divvy pre-approves you for a home shopping budget after a quick, free application (a soft credit check, no impact on your score). Minimum credit score is 550 (so yes, even if your credit isn’t great, you may qualify). Once approved, you can browse Divvy’s list of “Divvy-ready” homes in their markets – these are move-in-ready, single-family houses that meet the company’s . (Divvy does not do fixer-uppers, mobile homes, or condos, to ensure the home will be habitable and likely to appreciate.) You’ll need to have some savings for the upfront costs: typically 1%–2% of the home price as an initial home savings contribution (option fee) plus the first month’s . Divvy then buys the home in cash for you and covers closing costs and – you move in as a tenant.

During your lease (which is up to 3 years), about 25% of your rent is set aside as a purchase credit, accumulating to roughly 3%–10% of the home’s price by the end of . This essentially helps you build a down payment over time. You have the freedom to buy the home at any point during the lease; there’s no penalty for early . If you decide to buy, great – those savings plus any additional down payment you’ve saved will help you qualify for a mortgage. If you decide not to buy, Divvy will refund your accumulated savings minus a 2% relisting fee (they need to re-list and sell the house). In other words, you get back the portion of rent credits you built, but you lose the initial option fee (and that 2% fee comes out of your credits).

Where Divvy operates: Divvy Homes is available in multiple states and cities across the U.S. (though notably not yet in California as of 2025). Some major markets include Georgia (Atlanta, Macon), Ohio (Cincinnati, Cleveland), Texas (Dallas–Fort Worth, Houston, San Antonio), Colorado (Denver, Colorado Springs, Pueblo), Florida (Miami, Orlando, Tampa, etc.), Minnesota (Minneapolis), Missouri (St. Louis), Tennessee (Memphis), and Arizona (Phoenix). This makes Divvy one of the best rent-to-own programs in Texas and several other states, although Californians will have to look at alternatives for now.

Pros: Divvy’s appeal lies in its low barrier to entry (550 FICO, small down payment) and flexibility. You can pick a home from the market (within Divvy’s pre-approved list) rather than being limited to a company-owned . The process is quick – often approval in a couple of days and you can start home . Importantly, you’re not locked in; you can walk away if you change your mind (recouping some savings) or buy early if you’re ready. Divvy also handles the purchase logistics upfront, which removes a huge hurdle for buyers who can’t get a mortgage today.

Cons: The biggest caution is the cost. Divvy charges above-market rent (since part goes to your savings). If you never buy, you’ll have paid higher rent for nothing gained, aside from whatever refund comes back minus fees. Also, Divvy’s 3-year limit means this is not a long-term rental; you need to be mortgage-ready within that time. Lastly, because Divvy currently isn’t in California, Los Angeles buyers can’t use this program locally – you’d have to move to one of their markets. (However, keep an eye on expansion; companies often grow into new states.) And remember, if you back out, Divvy keeps a 2% fee which could equal a few thousand dollars lost. Overall, though, Divvy Homes is considered a legitimate rent-to-own company and a strong option for those who fit its model. It has helped many renters become owners, proving that “legit rent-to-own companies” do exist and can be beneficial.

Dream America – A Short-Term Lease-to-Own Boost

Dream America is another reputable rent-to-own program, and it’s known for its focus on a 12-month pathway to homeownership. Dream America’s requirements are a bit more lenient in some areas: they’ll consider credit scores as low as 500 , and they require applicants to show a household income of at least $4,000 per month, a decent rent payment history for the past year, a debt-to-income ratio under 50%, and about $8,000 in savings to put toward buying a . This program is aimed at folks who are on the cusp of mortgage readiness and just need that final push.

How it works: Dream America operates in a handful of states/metro areas: currently Atlanta (GA), Dallas (TX), and several Florida markets (Jacksonville, Orlando, Sarasota, Tampa). If you’re approved, you can choose any single-family home or townhouse for sale in those areas (as long as it fits Dream’s criteria: home price between $150,000 and $400,000, and relatively modern – built or renovated in the last 15 years). Dream America will then buy the home in cash for . You’ll pay a 1% option fee at closing (they call it an onboarding fee) plus your first month’s rent . The initial lease is 12 months. During that year, you rent the home and, ideally, work on qualifying for a mortgage. At any time that you secure financing, you can notify Dream America and purchase the home – they let you break the lease without penalty to become the . In fact, Dream will even apply 10% of the total rent you paid as a credit toward closing costs when you , which is a nice perk (it’s like getting some of your rent back as equity).

If the year passes and you’re not ready yet, Dream America will allow you to renew your lease and purchase contract for another term (up to a maximum of 2-3 years in total). However, note that the longer you rent, the higher the eventual purchase price becomes. Dream’s model has a built-in price increase: for example, if you buy the home after 6 months, you’ll pay about 6% more than what Dream paid for it (to cover their costs); if you wait 12 months, that premium might be higher (they haven’t specified here, but presumably around 10-12%). This means the clock is ticking – it’s financially better to buy sooner rather than later under this program.

What if you decide not to buy at all? In that case, once your lease is up (or you choose to walk away), Dream America will sell the house on the open market. If the sale price covers their costs, they’ve stated they will return your initial earnest money (option fee) after the sale, minus a 2% processing . Essentially, they also charge a fee if you don’t end up buying, similar to Divvy’s relisting fee. There’s some risk here: if the house sells for less than what Dream bought it for (or you caused damage, etc.), you might lose more than just your fee. But generally, they aim to make you whole on your deposit if everything goes fine, aside from that 2%.

Pros: Dream America’s big advantage is the short commitment. It’s a “try before you buy in one year” approach, which is great if you expect your situation to improve quickly. You’re not locked into multi-year rent payments at a premium – if you can get a mortgage in 6-12 months, you do it and you’re done (and you get a rent credit bonus of 10% back, which effectively reduces your purchase cost). The program is also fairly accessible: a 500 credit score and moderate income requirement opens the door to many who can’t get bank financing . And like Divvy, you get to choose a home from the market (within price limits), giving you more freedom to find a house you truly like, rather than being handed a specific property.

Cons: The flip side of the one-year term is pressure – Dream America is best for renters who are confident they can qualify for a mortgage soon. If your credit or savings need substantial work, one year might not be enough. Extensions are possible but each extension means the house costs more. Also, geographic reach is limited: if you’re not in GA, TX, or FL, Dream America isn’t an option yet. (They might expand, but as of now their footprint is narrow.) For Los Angeles or California readers, unfortunately this program isn’t available locally. Another consideration is that Dream requires you to have about $8,000 in savings – between the 1% fee and presumably reserves to cover later down payment – so it’s not “no money down.” And, similar to others, if you choose not to buy, you could lose a couple percent in fees. Nonetheless, Dream America is regarded as a legit rent-to-own home program with a solid track record, especially for those who just need a short rental period to get mortgage-ready.

Landis – Coaching Renters to Mortgage Readiness

Landis is a newer rent-to-own company (founded in 2018) that has gained attention due to its high-profile backers (including tech investors and even entertainer Jay-Z’s firm). Landis’s approach goes beyond just letting you rent and buy later – they focus on financial coaching to help you actually reach the point of mortgage approval. When you join Landis, you’re paired with a Homeownership Coach who will guide you on improving your credit score, debt-to-income ratio, and saving for a down payment during your lease . This hands-on guidance is what makes Landis stand out as one of the best lease-to-own programs for credit .

How it works: You start by applying online; Landis’s application is 100% free and won’t ding your credit (just a soft pull). They’ll review your finances and let you know your approved home buying budget – essentially the price range of homes you can pick . Landis currently operates in about 8 states: Alabama, Florida, Georgia, Indiana, Kentucky, North Carolina, Ohio, and . (They are not in California or Texas at the moment.) You can choose a house for sale in one of their markets that fits your budget, and if it checks out, Landis will purchase it on your behalf. They make a competitive all-cash offer (useful in hot markets) and even cover closing . You’ll need to provide an initial deposit of 2%–3% of the home’s price when Landis buys the . This acts as your security deposit and part of your eventual down payment savings.

Once you move in, you’ll pay rent to Landis. The monthly rent is set at market rate for the area (it can vary based on home price and location). Landis generally expects you to be ready to buy the house within 24 months (2 years); that’s the typical lease length (though it may vary case by case). During this time, your Homeownership Coach works with you regularly – they might help create a budget, give tips to boost your credit, and track your progress toward being . The idea is that by the time your lease is up (or sooner if possible), you’ll qualify for a mortgage and purchase the house back from Landis. Landis then assists you with the mortgage process to ensure a smooth .

Important to note: Landis’s model is a bit different in that not every program guarantees rent credits toward purchase. Landis does say a portion of your payment goes into savings, but details can vary. According to one review, Landis requires at least 550 credit and $3,000/month income to qualify, and reports your rent payments to credit bureaus to help improve your . They also may limit you to properties within their own inventory or pre-approved list (which is a potential con). However, Landis appears to be relatively transparent about costs; for example, if you walk away without buying, they may charge a fee (one report mentioned Landis charges around a 3% fee if you don’t purchase, to cover resale – similar to Divvy’s policy). Always clarify these terms with Landis directly, as their FAQ or reps can provide the latest details on fees and how much of your rent builds equity.

Pros: Landis is great for those who know they need some financial TLC before buying. The coaching element means you’re not left on your own to figure out how to improve your credit or save money – Landis wants you to succeed in buying the home, so they actively help you get . This program can be a good fit for people with moderate credit (550+) and stable income who are serious about becoming homeowners within a couple of years. Another plus: Landis’s application is free and there’s no obligation if you apply and then decide not to proceed; you haven’t lost anything but time. The fact that Landis uses a soft credit pull up front is also . And like other top programs, you can pick a home (subject to Landis’s approval) on the open market, giving you more choice.

Cons: The main downside is Landis’s limited market reach – they are not in California or many western states yet, and they have no presence in Texas either. So if you’re in Los Angeles or another area outside their states, you can’t use Landis until they expand. Another con is that while they help you save, you still need some upfront cash (that 2-3% deposit) which can be a chunk of change depending on the home price. Also, Landis’s business model means they might have slightly stricter criteria on which homes they’ll approve – they want houses that will appraise well and not require major repairs, to maximize the chance you can get a mortgage on it later. Lastly, as with any rent-to-own, if you don’t end up buying, you risk losing some money (and in Landis’s case, potentially a 3% fee if you walk ). However, Landis has positioned itself as a competitor to Divvy that emphasizes guidance and education, which can be invaluable for buyers who need that support system to reach the finish line. It’s certainly a legitimate lease-to-own company to consider if you’re in one of their states.

Home Partners of America (HPA) – A Once-Popular Program (Now Evolving)

Home Partners of America deserves a mention because for years it was one of the best rent-to-own home companies nationwide – including in California and Texas. HPA allowed renters to choose almost any home on the market (within approved areas and price ranges), then leased it to them with up to 5 years to buy. It was known for being family-friendly (longer terms, larger inventory) and had a strong . Minimum requirements were moderate: about a 600 FICO score and $50,000 household income (roughly $3,500/month) to . Home Partners operated in numerous states – as of early 2025 it was available in at least 20 states, including California, Texas, Arizona, Florida, Illinois, and . This broad reach made it a go-to option for many, and it answered the question “companies like Home Partners of America” by essentially being the benchmark.

However, if you’ve searched for HPA recently, you might be confused. What happened to Home Partners of America? In 2021, the company was acquired by the investment firm Blackstone. By late 2024, news broke that Home Partners was winding down its program for new . In other words, HPA stopped accepting new homebuying applications (likely due to changes in market strategy by the new owners). Existing rent-to-own tenants under HPA weren’t abandoned – their leases and purchase agreements were taken over by a company called Tricon Residential in early . Tricon is now managing those homes and honoring the original terms for renters who are part of HPA’s . They’ve assured tenants that their option to buy (timing and pricing) remains the same under . But crucially, if you are a new buyer today, you cannot sign up for Home Partners of America like people could in past years. The program in its classic form is essentially closed to new entrants.

What does this mean for you? If you’re researching rent-to-own and come across HPA’s name, understand that it was legitimate and helped many families, but it’s not an option going forward. Instead, you should look at HPA’s competitors: companies like Divvy, Landis, Dream America, and others we discuss here are effectively the alternatives now. In fact, HPA’s closure is one reason newer firms (and smaller regional programs) are getting more attention – they’re filling the void.

Pros (historically): HPA let you pick almost any home for sale within certain cities, giving tremendous . They also allowed up to 5-year leases, providing stability for families who needed longer to prepare for . Rent increases and purchase price were all laid out clearly, and you could buy anytime. It was a well-oiled machine and had a large footprint (including Los Angeles and many California markets, as well as Texas).

Cons: HPA did require a full application with a ~$75 fee and background checks, and tenants were responsible for some maintenance costs. But the main “con” now is that it’s no longer available to new customers. Some critics also noted that if you didn’t buy, HPA did not refund the rent premiums you paid, and their annual rent increases could add up. But generally, it was regarded positively – its shutdown was more about corporate decisions than any scandal.

Key takeaway: Home Partners of America’s competitors and similar companies are stepping in to serve renters today. If you were interested in HPA, consider Pathway Homes, Divvy, or others as the new alternatives (and if you’re already in HPA, check with Tricon Residential for any questions on your lease).

Pathway Homes – Regional Rent-to-Own with Higher Credit Requirement

Pathway Homes is another rent-to-own company making waves, particularly in certain regions. Pathway is based in Texas and operates in select markets including Dallas–Fort Worth (TX), Atlanta (GA), Charlotte (NC), Nashville (TN), Orlando & Tampa (FL), Denver (CO), and Phoenix (AZ). Like others, Pathway will purchase a home for you and lease it back under an option-to-buy agreement. Pathway’s differentiator is that they offer a couple of variations in their program (one of their offerings is called “Pathway Rent+” which might have some flexible terms or savings match, according to their site).

To qualify for Pathway, you’ll generally need a slightly stronger profile: around a 600 minimum credit score (which is higher than Divvy or Dream require). They also look at income and rental history, of course. If your credit isn’t where you want it, Pathway even suggests improving it first – they partner with a credit repair service (Credit Saint) as a trusted partner to help applicants boost their , indicating they want renters who are likely to succeed in buying. Pathway’s process involves choosing from their list of move-in ready homes in the markets they serve. In fact, you can go to their website and browse available rent-to-own listings in each . This suggests they may operate a bit like a hybrid of a listing service and a buy-for-you model. Pathway’s site touts “zero down payment” options – which likely means they don’t require more than the first month’s rent and maybe a security deposit to move , making it feel almost like a normal rental (we’d need to confirm specifics, but one snippet indicates Pathway offers a way to get in with no large down ).

During the lease, you work on qualifying for a mortgage. Pathway, like others, will have an agreed upon purchase price and a timeframe (often 3 years or so). They also appear to promote homeownership education – offering resources to help renters prepare for the responsibilities of . One thing to watch: Pathway is reported to have the highest minimum credit score requirement (600) among major rent-to-own . The reasoning could be that they want tenants who are very likely to buy successfully, which is good for both parties in the end. If you’re below 600, you might need to improve your score or look at other programs first.

Pros: For those who meet the criteria, Pathway Homes provides access to quality homes in several big markets. It’s backed by serious investors (often these firms have substantial funding), and because they require higher credit, their customers might experience a higher success rate of transitioning to ownership. The ability to browse Pathway’s listings online is also convenient – it’s like shopping for a home on a regular real estate site. Pathway also emphasizes transparency in terms of costs and process; they likely disclose upfront how any fees work and how your rent/purchase price is set (as noted in a tech equity report, many top companies, presumably including Pathway, are transparent about fees and how option pricing changes over ).

Cons: The stricter approval bar means many renters who have credit issues might not get approved by Pathway. If your FICO is in the 500s, consider Divvy or Dream first. Also, Pathway’s geographical coverage, while decent, still doesn’t include places like California. If you’re in Los Angeles, Pathway is not directly available here. Another consideration: because Pathway markets “no down payment,” be sure to read the fine print – you may not need a big option fee, but there could be other upfront costs (application fees, etc.). As always, if you don’t end up buying through Pathway, you should expect that any extra rent paid toward purchase and option fees would be forfeited or partially refunded minus fees. Fortunately, Pathway’s reputation so far is positive, and we’ve excluded any notorious programs or scams to focus only on companies like Pathway that are legit.

Verbhouse – Innovative Pilot for High-Cost Markets

For buyers in ultra high-cost areas (like California), Verbhouse is an intriguing newcomer in the rent-to-own space. Verbhouse is a San Francisco-based startup that aims to make homeownership more accessible in expensive . They have a unique model: Verbhouse lets you lock in a purchase price for up to 5 years and requires a larger upfront contribution (usually 5%–10% of the home’s price as a down payment), but in exchange, you get some unusual benefits. With Verbhouse, 100% of any appreciation in the home’s value is yours – even if you don’t end up buying the ! This is very different from other rent-to-own companies that typically keep any increase in value for themselves. Verbhouse essentially treats you like an owner from the start: you put more money in (hence you have skin in the game), they lock your rent and price for 5 years, and if the market goes up a lot, you can even choose to sell the home (Verbhouse would handle the sale) and cash out the equity gain without ever having to use a . According to an analysis by Moody’s, Verbhouse was the only company found that lets renters cash out their option at fair market value and keep the profit, rather than exercise and . In other words, if life changes or you can’t buy, you might still walk away with money if the house appreciated – a truly innovative twist on rent-to-own.

How it works: Verbhouse’s process is somewhat similar at first – you apply and get approved (they say it’s a “holistic” process with no “annoying little fees”). Once approved, you shop for a home (presumably within certain price ranges and areas, likely focused in California to start). Verbhouse buys the home with cash. You then put down your 5-10% upfront with Verbhouse to lock in your purchase price and monthly . They set your monthly lease payment to be equivalent to what owning would cost (so it’s comparable to if you had a mortgage – and crucially, they don’t raise the rent annually; it stays fixed for up to 5 years). During the lease, you’re free to live like an owner: you can decorate, have pets, even do , and Verbhouse covers major . Over those years, part of your payment builds equity (like any rent-to-own), and you capture any market appreciation. By or before the 5-year mark, you can exercise your option and buy the home (likely using a mortgage that you hopefully qualify for by then). If you choose not to buy, you have options: potentially extend the lease, or sell the home in the open market. If sold, you get your equity back plus any increase in value after paying back Verbhouse’s initial costs. This way, you don’t lose the wealth you built just because you didn’t take title.

Pros: Verbhouse is designed for markets like Los Angeles or San Francisco, where prices often rise and many middle-income families are priced out. It gives you a way to participate in the market gains without outright owning from day one. The fixed rent for five years offers stability (no surprise hikes), and knowing your price won’t change is great for planning. If the home value skyrockets, you benefit; if it falls, you aren’t obliged to buy (you’d lose your upfront 5-10%, but that’s a risk with any option fee). This program is like a bridge between renting and owning that leans more toward owning. It’s also worth noting Verbhouse is fairly selective – by requiring a larger initial investment, they ensure participants are committed and less likely to default. As a result, it doesn’t feel like a predatory setup; it’s more a partnership to help you build equity.

Cons: The obvious barrier is the need for 5-10% down upfront – in Los Angeles, where median home prices are very high, that could be a substantial sum (tens of thousands of dollars). Not everyone considering rent-to-own will have that ready. Also, Verbhouse is still a pilot program (limited rollout). They might only be in certain California locales initially (possibly Bay Area, and hopefully expanding). Availability is limited, and you have to apply to see if you qualify. This is not geared toward those with low credit or very little savings; rather, it’s for those who could almost get a mortgage but just need a bit more time or a way to start building equity now. Another con: If the market stays flat or goes down, you might have been better off just waiting and buying normally – with Verbhouse you’d pay some premium for the option. And if you decide to back out, while you can recoup some money via sale, there’s no guarantee of profit. In a flat market, you might lose some of that 5-10% to transaction costs.

In summary, Verbhouse is a promising rent-to-own innovation to watch, especially for California homebuyers. It shows that not all rent-to-own sites operate the same; some, like Verbhouse, are really trying to align with the buyer’s interests (since you share in gains). If you have a decent chunk of savings and are eyeing an expensive market, it could be worth exploring. Just make sure to compare it against other options, like simply saving more for a traditional purchase or looking into assistance programs.

Other Noteworthy Programs and Tips

Beyond the major players above, there are a few other alternatives and tips for finding houses for rent with option to buy:

Local or Individual Lease-Option Deals: In Los Angeles, you might find individual homeowners willing to do a lease-option. These aren’t large programs, but sometimes a landlord who wants to sell might agree to give a tenant an option to buy. Be very careful with these “for sale by owner” rent-to-own deals – read the contract and maybe hire an attorney to review. There’s less oversight with individual deals, so the risk of hidden fees or scams is higher. But if done right, a private lease-option can be a win-win: you lock in the home you’re renting. Websites like RentToOwnLabs or HousingList compile rent-to-own listings (often these are individual owner listings). Just vet each opportunity thoroughly. Remember, if an offer sounds too good to be true (like "no credit check, no money down, government rent-to-own program!"), approach with skepticism. Legit rent-to-own companies will still want to see income and some savings – nobody gives a house “for free.”

“Free” Rent-to-Own Programs: You might see this term, but in reality no rent-to-own program is truly free – the companies need to make money somehow. When people search for free rent-to-own programs, they may be looking for ones with no upfront fee. While you’ll almost always have to pay something upfront, some programs do let you roll a portion of fees into rent, or like Pathway, advertise no down payment (meaning only first month and security due at move-in). One thing that is often free is the application process – for example, Landis and Divvy do not charge an application . Take advantage of that to apply and see your options without cost. But be wary of any service asking for a large registration fee just to give you a list of rent-to-own homes – those could be scams or unnecessary middlemen. Stick with known companies or get help from a real estate agent.

Government Rent-to-Own Programs: If you’re hoping the government has some rent-to-own home program for low-income families, the reality is there isn’t a federal rent-to-own scheme. The U.S. Department of Housing (HUD) doesn’t directly offer rent-to-own houses. However, the government does provide other pathways to homeownership. For instance, there are down payment assistance programs and first-time buyer grants. In Los Angeles, the city and county run programs like the Low-Income Purchase Assistance (LIPA) and Mortgage Credit Certificate (MCC) programs, which help with down payments or tax credits for first-time buyers. These aren’t rent-to-own, but they can make buying a home more feasible by reducing upfront costs. There’s also HUD’s Section 8 Homeownership Voucher in some areas (which allows certain voucher holders to apply their assistance toward a mortgage payment). The term “government rent-to-own” might also refer to nonprofit programs or public-private initiatives where a housing authority helps tenants buy the homes they rent. For example, some cities have had pilot programs where tenants in public housing could eventually buy their unit. But these are special cases. Generally, be cautious of anyone advertising themselves as a government rent-to-own program – verify their legitimacy. More often, you’ll be combining a private rent-to-own program with government assistance (like using a VA loan at the end, or a state grant for your down payment).

Best Rent-to-Own Websites: Aside from the companies we profiled (which all have their own websites where you apply), a few websites aggregate rent-to-own opportunities. We mentioned RentToOwnLabs and HousingList for listings. There’s also HomeFinder’s rent-to-own section, and Local MLS listings sometimes note “lease option available.” Just know that many “rent-to-own listing” websites simply pull data or require a membership to view details – you might end up contacting an owner directly. The best rent-to-own sites in terms of actual programs are those of the companies we’ve covered: e.g., Divvy’s website, Landis’s site, etc., where you can see if you qualify and browse homes they support.

Companies Like Divvy and Home Partners: We’ve covered Divvy, Dream, Landis, Pathway, Verbhouse – these are Home Partners of America competitors filling the space. A couple of others worth a quick mention are Landis’s fellow fintech competitor (e.g., Ribbon, which helps with cash offers but not exactly rent-to-own) and some older programs like Trio (a lease-to-own program that works with government-backed loans, mainly in a few states). ZeroDown was a San Francisco startup similar to Divvy, but it required a hefty upfront fee and its status is unclear after an . And of course, traditional lease-purchase builders: for instance, some builders or apartment companies offer rent-to-own credits. One example: Shea Homes (a builder) has a program where if you rent in one of their communities, they’ll credit a portion of your rent toward buying a new Shea home (up to $3,600). It’s not a full rent-to-own contract, but it’s a nice perk if you were renting there anyway. So keep an eye out for specific offers like that, especially if you’re renting in a corporate-owned community.

Rent-to-Own in Los Angeles: A Local Perspective

Now let’s talk specifically about Los Angeles, California. How do rent-to-own programs apply here, and what should Angelenos consider?

First, it’s important to note that many national rent-to-own companies do not operate in California. Why? California’s home prices are high, and there are legal regulations that make pure lease-options a bit trickier. For example, Divvy Homes doesn’t currently buy in California (though it’s eyeing expansion), and Landis and Pathway also skip CA in their market lists. One major program that did serve California was Home Partners of America, and as we covered, that program stopped new operations in . So, a Los Angeles buyer might not have a readily available big-name program to call up like someone in Texas or Georgia would. This means you might have to explore alternative paths a bit more creatively. Here are some tips for LA:

Check for Local Programs: Occasionally, there are local initiatives. For instance, some non-profits or city programs have offered “housing lease-to-own” plans for specific populations (teachers, low-income families, etc.). These can be limited in scope. It’s worth doing a search or asking a housing counselor about any Los Angeles rent-to-own or first-time buyer assistance programs. The Los Angeles Housing Department (LAHD) doesn’t run a rent-to-own, but they do offer the down payment assistance (LIPA) and affordable homeownership programs which could be combined with a private rent-to-own or help you buy outright.

Consider the Suburbs or Other SoCal Areas: If you’re open to it, some rent-to-own companies might cover areas just outside the expensive core. For example, Home Partners (when it was active) had homes in parts of Inland Empire or Orange County. If any new program emerges, it might start in slightly more affordable pockets of Southern California. As of now, however, none of the big three (Divvy, Landis, Dream) list California markets. Verbhouse is a hopeful sign because it’s actually targeting California. If you’re in L.A. and really want a rent-to-own, you could look into Verbhouse’s pilot or wait for others to catch up.

Private Lease-Options: In L.A., given the competitive market, a homeowner might not need to offer rent-to-own (they can often sell traditionally). But if you come across a listing that’s been on the market a long time, or a landlord who is investor-minded, you could propose a lease-option. Work with a real estate agent experienced in creative financing – they sometimes broker deals where a tenant-buyer gets an option to purchase. Be prepared to explain how it benefits the seller (guaranteed sale down the line, some cash now, etc.). MaxNet Homes, for instance, though not offering a rent-to-own program, can help connect you with alternative solutions – as a local real estate brokerage led by Tricia Watts, we have knowledge of the market and could identify potential opportunities or advise if a lease-option is even viable on a particular property. Essentially, leverage local expertise to find that needle in a haystack.

Affordability and Timing: Los Angeles has a median home price far above the national , which means the hurdle to buy is high. Rent-to-own can be attractive here because if prices keep rising, locking in today’s price is . However, the opposite is also true: if the market cools or drops, a rent-to-own buyer in L.A. could be stuck overpaying. So it’s a bit of a gamble. Pay attention to market trends or choose a contract that has some flexibility (maybe a shorter term or a fair escape clause). Given the cost of living in L.A., also be realistic about the premium you’ll pay during the rental – ensure it fits your budget so you don’t jeopardize your eventual mortgage approval by falling behind on rent.

Neighborhoods: If you do find rent-to-own opportunities, they might be more common in certain areas. Highly competitive neighborhoods (say, West LA or coastal areas) probably won’t have any, whereas areas with more new construction or farther out suburbs might. The Ark7 blog suggests focusing searches by ZIP codes and looking for owners who might consider . In LA County, that could mean looking at places like Palmdale/Lancaster (where developers might be open to creative sales) or older homes in areas where listings sit longer.

In summary, rent-to-own in Los Angeles is possible but requires extra diligence. You may not have as many ready-made program options, so you’ll lean on professional guidance, hybrid solutions, or even consider relocating to use a program in another city. Always weigh it against other options: Could you buy with an FHA loan now? Could you save faster with a tighter budget and just purchase traditionally? Sometimes a rent-to-own is the perfect bridge; other times, especially in CA, you might find a different approach gets you the keys faster.

Pros and Cons of Rent-to-Own (Quick Recap)

Before we wrap up, let’s summarize the general advantages and drawbacks of rent-to-own home programs, so you can make an informed decision:

Pros:

Path to Homeownership for Credit-Challenged Buyers: If you have a low credit score or past financial hiccups, rent-to-own gives you time to repair your credit while already living in the home you want to . Many programs accept fair or even poor credit (we’ve seen 500-550 FICO minimums) and help you improve it.

Build Equity Gradually: Part of your rent is working for you by accumulating as a down payment fund. Instead of rent being “dead money,” a portion becomes your future ownership . This forced savings can be very helpful if you struggle to save on your own.

Lock in Purchase Price: In markets with rising prices (like L.A.), locking in today’s price can mean instant equity by the time you buy, or at least protection from . You’re essentially hedging against home price increases.

Test Drive the Home: You get to try out the property and neighborhood before fully committing to . If you discover issues or simply don’t love it, you have the option to not purchase at the end (if it’s a lease-option contract). This can save you from buyer’s remorse.

Less Upfront Cash than Buying: Although not “no money down,” rent-to-own usually requires a smaller upfront amount than a traditional mortgage down payment. For example, 1-3% option fee vs. 10-20% down payment on a purchase. It’s a way to get in the door with less cash (though remember, you’ll eventually need financing if you buy).

Flexible Timing: You don’t have to rush into a mortgage. You can take a year or two to prepare financially, all while knowing the home is waiting for you. For folks who need to pay down debt or build income history, this flexibility is gold.

Cons:

Cost Premium: Rent-to-own is often more expensive overall than buying . You pay above-market rent, plus upfront fees. If you add up the total payments (rent premiums + option fee + eventual purchase price), you might end up paying more than if you had bought via a mortgage . The premium is the price of the opportunity and flexibility you’re getting.

Risk of Losing Money: If you don’t purchase the home, you likely forfeit the option fee and any rent credits (some programs refund a portion, but many costs are non-refundable). That could be thousands of dollars lost, and you walk away with no house. Even if you do buy, some programs build in price markups that mean you’ve essentially paid a chunk of “extra” money compared to market value.

Locked in (to an Extent): With a lease-purchase, you must buy or face legal consequences (like losing money or even being liable for breach). Even with lease-option, once you’re in the program, you might feel psychologically locked in because you’ve invested money. Life happens – job transfers, family changes – but backing out of rent-to-own can be costlier than breaking a normal lease.

Responsibility Without Full Ownership: Often, rent-to-own tenants may be responsible for maintenance and repairs like a homeowner. The contract might stipulate that you take care of the property. If a major system fails, you could be on the hook, which is something renters usually aren’t. This blurred responsibility can be a financial . (Some companies like Verbhouse and Home Partners cover big issues, but always verify who pays for what.)

Market and Financing Uncertainty: If the housing market declines, you might be stuck with an agreed price that’s now too high. If interest rates shoot up, getting a mortgage to buy the home could become harder or more expensive than anticipated. And there’s always the chance that you still can’t qualify for a mortgage at the end – perhaps due to a job loss or other debt – and then all the plan falls apart. Rent-to-own doesn’t guarantee you’ll get a loan; it just gives you time to position yourself.

In weighing these pros and cons, consider your personal situation. Ask yourself: Can I realistically get a mortgage in a year or two? Do I have the financial discipline to benefit from this program? Is the home (and price) one I’m confident about? Also, compare with alternatives: maybe a family help, or a different loan program (FHA, VA, etc.), or even postponing buying until you’re more ready. Rent-to-own is just one tool in the toolbox of homeownership, particularly useful for those in between renting and buying.

Conclusion: Taking the Next Step Toward Homeownership

Rent-to-own home programs can indeed “help you get into that house,” turning renters into owners through a gradual process. We’ve explored a variety of lease-to-own programs – from big names like Divvy and Landis to specialized options like Verbhouse – and highlighted how they operate. The good news is yes, there are legit rent-to-own companies out there, and we’ve outlined some of the best rent-to-own home companies above. Each comes with its own flavor and requirements, so the key is finding the one that best fits your needs and location. If you’re in Los Angeles or anywhere in California, you’ll need to navigate a bit more creatively, but the dream of homeownership is still within reach. Whether it’s leveraging a rent-to-own program in another city, negotiating a local lease-option, or using down payment assistance to buy outright, there are pathways for you.

At MaxNet Homes, even though we don’t directly offer a rent-to-own program, our mission is to help you explore all your home buying options. Led by Tricia Watts, we pride ourselves on transparency, expertise, and empathy. We understand that buying a home is a big step – and not everyone can take that step through the traditional route. That’s why we stay informed about creative solutions like rent-to-own, so we can guide you toward the program (or strategy) that makes sense for your situation.

Are you ready to stop renting and start owning? We’re here to help. Contact MaxNet Homes today to discuss your homeownership goals. We can answer your questions, connect you with trusted resources, and develop a personalized plan to get you into your own home – whether through a rent-to-own program or a conventional purchase. The journey to owning a home can feel overwhelming, but you don’t have to navigate it alone. Let’s work together to turn your “someday” into a solid plan today. Your Los Angeles dream home might be closer than you think. Give us a call or send us a message, and let’s take the next step toward your future home sweet home.

Call-to-Action: Ready to explore your path to homeownership? Reach out to Tricia Watts and the MaxNet Homes team for a friendly, no-obligation consultation. We’ll help you weigh all your options – including rent-to-own programs – and put you on the right track to owning your home in Los Angeles. Don’t wait – your dream of becoming a homeowner is achievable, and we’re excited to help you make it happen!

The Best Way To Sell Your House Quickly

Stuck in foreclosure? Facing a messy divorce? Liens against the title? Probate? MaxNet Homes helps property owners all over Los Angeles and other parts of CA sell their homes fast.

There’s no issue we haven’t dealt with! We’ve helped homeowners who own vacant property, have a house about to go to auction, are stuck with a hoarder inheritance, retiring and want to downsize, and more. Call us today and let’s work together to find a solution to whatever situation you might be facing.

We buy houses in CA, including Los Angeles and the surrounding area, for a competitive cash price on a schedule that works for you. Since we also operate as traditional real estate agents, our knowledge and experience of the local market means that we can help you get top dollar for your house through a traditional home sale. If you’re looking to maximize the amount you can get for your house, we will partner with you to list your Los Angeles, CA house to sell it for top dollar.

To start, let us know about the property you’re ready to see in your rearview mirror. Let us know if you would like to sell that unwanted house or rental property for a competitive cash price fast or work with us to get the most money possible with a traditional home sale.

We buy houses in Los Angeles and all surrounding areas in CA. If you need to sell your house fast, connect with us today. We would love to make you a no-obligation cash offer that is hassle-free. 🙂

Call us today at 1 844-MAXNET-8