Los Angeles’ Trusted Home Buyer: We Buy Houses For Cash! No Repairs. No Commission.

Sell Your House FAST In Los Angeles, CA

Get a Cash Offer From a Local Home Buyer.

Sell As-Is. Pay Zero Fees. Move On Your Timeline. No Repairs, Cleaning, Or Showings.

MaxNet Homes is a cash home-buying company that treats our customers right. We know that often times, your house is your largest investment, so we want to make sure you get the MaxNet offer for your home! We buy houses in Los Angeles for cash. We are not here to waste your time or make you a lowball cash offer. We are here to help – not to haggle. When you need to sell your house fast, we will give you our MaxNet Offer every time! You will also be treated with respect because we value your time.

With MaxNet Homes, getting a cash offer for your house is 100% FREE. There are never any obligations. So why not see if we are a good fit before locking yourself into a listing agreement with an agent? You’ve got nothing to lose!

You can see Tricia in action on HGTV’s Flipping 101, Season 2, Episode 7 “ Hope the Buyers Have a Dog” – watch as she transforms a distressed property into a beautiful home.

"We were dealing with some family issues and needed to sell my dad’s house quickly. I reached out to Tricia, and she came by that same day! She was knowledgeable, easy to talk to, transparent, and — most importantly — genuinely cared about our situation. Tricia went above and beyond to make the process easy for my elderly father. She checked in on him regularly to see how he was doing, respected his wishes (including leaving his beloved palm trees untouched), and even accompanied him to escrow because she could tell the process felt intimidating to him. She was able to close on our house under 30 days which helped alleviate a huge headache for my dad. I would highly recommend Tricia with MaxNet Homes!"

Trevor Reverditto

An Honest L.A. Home Buyer

When you need to sell your house fast, it’s important to work with a home buying company that is honest and has a track record of treating people fairly.

Meet Tricia, the founder of MaxNet Homes! Tricia started this company with a simple goal – to streamline the process of selling a home, even under tough conditions. What’s most important to Tricia is that she wants to do right by the people she works with because she knows that selling a house can often be stressful.

Tricia has a tremendous knack for problem solving and takes joy in giving sellers the best service possible when buying their home. A fun fact about Tricia, she was featured in the hit HGTV show Flipping 101 with Tarek El Moussa – Season 2.

“Couldn’t have asked for more!”

Hear from a happy home seller in Buena Park, CA who had an amazing experience working with MaxNet Homes. From start to finish, our team made the process smooth, professional, and stress-free

– Karen⭐⭐⭐⭐⭐

Benefits of Selling to MaxNet Homes

Get a Competitive, All-Cash Offer Within 24 Hours

When MaxNet Homes buys your house, it’s our goal to make everything as easy as possible for you. Here are the guarantees that you can expect when we buy your Los Angeles house:

Get A Fast Offer In 24 Hours

Once we have your address, we will get straight to work on running our numbers and can have an offer for your home in 24 hours or less. We don’t even need to see your property to make you an offer, we just need to see some pictures of it! That way it saves you time and the hassle.

No Open Houses

When you sell your house with a realtor you’ll have to do an unlimited amount of open houses and showings, so there’s a lot of pressure to have the house looking perfect at all times. But not with us, we just need to see the house once and we don’t even care if it’s dirty!

Pick Your Closing Day

One of the best parts of selling your house to us is that we can give you the certainty of when you need to close by. So whether you want to close next week or in a few months, we can work around your timeline so that closing day happens when you need it to.

No Commissions

When you sell your house to MaxNet Homes, you’ll save thousands of dollars on real estate commissions because we don’t charge you a cent. Plus, we’ll even go the extra mile and pay for all of the closing costs so that you won’t have to pay any fees when we buy your house.

Sell As-Is with No Repairs

Do you want to forget about all of the repairs your house needs and sell it without having to fix anything or even lift a broom? Selling to us means we buy your house as-is, and will never ask you to fix anything before we buy it. Making the sale completely hassle free!

Company That Buys Houses in Los Angeles, CA

We buy houses as-is in Los Angeles, CA, no matter what condition! That means you don’t need to lift a finger or spend unnecessary cash to sell your house. We buy houses as-is in Los Angeles to fix and then eventually resell them. So we are ready to do the work and have teams to handle big projects. You can leave behind whatever you don’t want, and we’ll handle the grunt work!

Choose The Best Way To Sell A House In Los Angeles

Los Angeles homeowners no longer have to settle for a “one option fits all” model for selling a house or rental property. Whether you have the patience to sell your home for top dollar with one of our experienced real estate agents or you would prefer the speed and convenience of a no-obligation, all-cash offer, MaxNet Homes has you covered. We make selling a home easy!

Our “Quick & Convenient Sale” Option:

Sell your house to MaxNet Homes

Sell without the hassles and stress of a traditional listing with our Cash Offer Program.

Competitive cash offer within 24 hours

Tell us about your property, we’ll evaluate it, and provide you with an obligation-free all-cash offer.

No showings, no hassles

You won’t need to disrupt your life with open houses, weekend showings, and non-stop cleaning.

You choose your closing day

Once you accept our cash offer, you won’t wait 30+ days to close. We close on your preferred date.

We’ll cover any repairs

We’ll handle repairs for you and will even haul off unwanted items at no extra charge.

We pay all closing costs

Closing costs can add up. Our cash offers are all-inclusive, which means there are no hidden fees.

No fees or commissions

By buying your house directly from you, we charge no fees and no commissions.

Our “Sell For Top Dollar” Option:

List your house with MaxNet Homes

The preferred option for homeowners who want to maximize their sale price with a traditional home sale.

Maximize your sale price

We’ll sell your house for the highest possible price with our wide buyer network and the best marketing in Los Angeles.

Peace of mind – no matter what

If a buyer’s financing falls through or your circumstances change and you need to move up your timeline, you have more than one option to sell.

Local expertise & knowledge

From setting the right list price to closing without a hitch, you’ll be supported through every step by our Los Angeles real estate experts.

Our Cash Offer is on standby

When you list with MaxNet Homes, you can activate our local Cash Offer Program at absolutely any time.

How It Works

(Yes, it’s really this easy!)

You could have an all-cash offer within 24 hours and close in as little as 7 days. To start, simply tell us about your Los Angeles area house through our easy information form or give us a call at 1 844-MAXNET-8.

STEP 1

Tell us about your Los Angeles house. We’ll get to work analyzing your property.

STEP 2

We make you a competitive cash offer based on the market value and condition of your home.

STEP 3

Choose the selling option that works best for your unique situation.

We’re Buying Houses All Over

Southern California

Being professional cash home buyers, MaxNet Homes is the fastest option to sell your house. Don’t own a house in Los Angeles? That’s OK! Dealing in Los Angeles homes is our expertise, and those located in the surrounding cities of Riverside, San Bernardino, San Diego, and Orange County. If you want a fast, hassle-free sale, we’ll make you a competitive cash offer to buy your house. We know the challenges you face when you sell your house and will handle any real estate challenge that comes your way. We promise to treat our Los Angeles customers with kindness and respect. Our service is 100% FREE, and we NEVER charge a commission. Calling us could be the best decision you make today.

Sell My House

Cash California

Sell My House

Cash California

Cash Home

Buyers California

How Fast Do You Need To Sell Your House In CA?

As CA‘s trusted investment company, as well as licensed and reputable local real estate agents, MaxNet Homes will help you sell your house the best way for your situation.

Some of the ways we work with Los Angeles homeowners include:

• We will list your house on the MLS using our proven proprietary marketing methods to sell your property for top dollar.

• Or, if you want the speed and convenience of an all-cash sale, we will make you a competitive cash offer and close on the date of your choice.

Give us a call today at 1 844-MAXNET-8 and let us know which option works best for you!

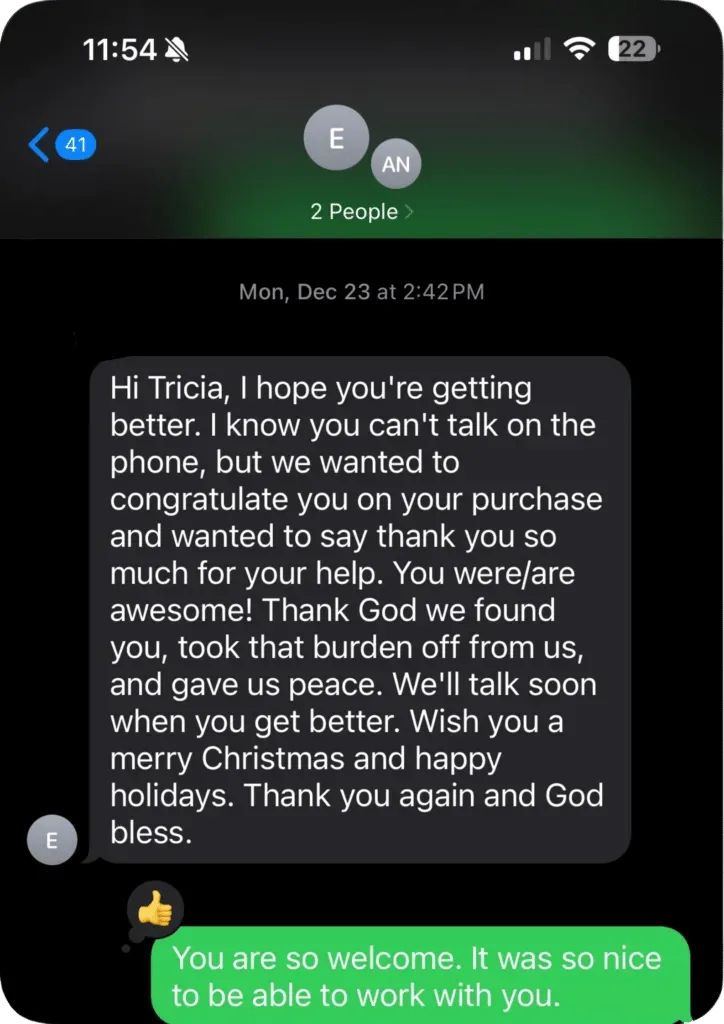

Real Stories, Real Relief

Hear from a happy home seller in Buena Park, CA who had an amazing experience working with MaxNet Homes. From start to finish, our team made the process smooth, professional, and stress-free.

Thinking of selling? Let’s make it easy.

📞 Reach out today for a fast, hassle-free cash offer!

We Buy Houses In Los Angeles In ANY Situation

It doesn’t matter whether you live in it, you’re renting it out, it’s vacant, or not even habitable. We help homeowners in CA stuck in difficult situations. You are not alone! Even if you’ve previously listed the property, the house needs repairs you can’t afford, is fire damaged, or has bad rental tenants, MaxNet Homes wants to work with you to find a solution to whatever issue you might be facing. Read more below:

Expensive Repairs

Did your house suffer major damage in the last storm? Do you want to sell but your kitchen needs upgrades that are too expensive for your pocket book?

Problem Inheritance

Did you inherit a property that’s stuck in probate, has back taxes, or is filled to the rafters with trash?

Divorce

Going through a messy divorce and you need to sell as quickly as possible?

Foreclosure

In default on your mortgage or taxes? Is your house scheduled for auction?

Relocating Out Of State

Need to relocate for work or retirement and want a fast and straightforward sale?

Bad Tenants

Sick of being a landlord with tenants and can’t keep up with property upkeep? Tired of the hassle of finding new tenants?

A Faster and Lower Cost Way To Sell Your Los Angeles House

It doesn’t matter whether you live in it, you’re renting it out, it’s vacant, or not even habitable. We help homeowners in CA stuck in difficult situations. You are not alone! Even if you’ve previously listed the property, the house needs repairs you can’t afford, is fire damaged, or has bad rental tenants, MaxNet Homes wants to work with you to find a solution to whatever issue you might be facing. Read more below:

Avoid open houses and daily showings

No closing costs or commissions

No need to pay for a single upgrade or repair.

Already got an offer? Let us try to beat it!

See what we can offer for your house today.

MaxNet Homes makes selling a house in CA fast, easy, and hassle-free! By offering multiple options to sell that traditional Los Angeles real estate agents and cash home buyers can’t offer, we will help you sell your home on a timeline that works for you. Even if your house needs major repairs, we want to purchase it from you as-is. We buy houses in any condition.

Contact us and submit the short property information form (below). We can give you a competitive cash offer in as little as 24 hours and we can close whenever YOU choose to close, or we can figure out the best way to list and market your property to sell for the highest price possible in your neighborhood.

Best of all, because we don’t have to rely on traditional bank financing if you need the cash quickly we can close in as little as 7 days. (Go here to learn about our process →)

Before You List Your Los Angeles House, Get A Competitive Cash Offer From Us!

No matter what condition your house is in; no matter what situation or timeframe you’re facing…

Our goal is to help make your life easier. We want to get you out from under that house or property in CA that’s stressing you out. With our simple Cash Offer Program, we can pay you a competitive and honest price for your house or guide you through the steps to list your home on the market for top dollar. Either way, we’ve got you covered!

Get Your Fast, Competitive Offer Today!

START HERE: We buy houses in ANY CONDITION. Whether you need to sell your home fast for cash or list with a local agent for top dollar, we can help.

Frequently Asked Questions

How much does a house cost in Los Angeles?

Average price: $850,000

Range: Depends on location, size, and condition

Tip: To sell your Los Angeles house fast, you can skip repairs and list with a cash buyer.

Contact MaxNet Homes today for a fast, fair offer.

How much does a house cost in Los Angeles?

Average price: $850,000

Range: Depends on location, size, and condition

Tip: To sell your Los Angeles house fast, you can skip repairs and list with a cash buyer.

Contact MaxNet Homes today for a fast, fair offer.

How do I find the blueprints for my house in Los Angeles County?

Check with Los Angeles County Department of Public Works

Visit your local city’s building and safety office

Ask previous owners or builders if available

No blueprints? No problem — sell your Los Angeles house fast with MaxNet Homes.

Contact MaxNet Homes for a quick cash offer today.

How much is the one house in Los Angeles?

Original list price: $295 million

Final sale price: Around $141 million (2022)

Location: Bel-Air, Los Angeles

Want to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick and fair cash offer today.

How do I find out who owns a house in Los Angeles?

Search Los Angeles County Assessor’s website

Request records from the County Registrar-Recorder’s office

Hire a title company for detailed reports

Need to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick cash offer today.

How do I find out who owns a house in Los Angeles?

Search the Los Angeles County Assessor’s website

Request records from the Registrar-Recorder’s office

Hire a title company for deeper research

Looking to sell your Los Angeles house fast?

Contact MaxNet Homes for a fast cash offer today.

How much do I need to live comfortably in LA?

Estimated income: $75,000 to $100,000 per year

Factors: Rent, transportation, food, healthcare

Housing costs heavily impact your budget

Need to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick cash offer today.

Is it cheaper to buy or build a house in Los Angeles?

Buying is usually cheaper than building

Land, labor, and materials drive up construction costs

Existing homes offer quicker move-in options

Looking to sell your Los Angeles house fast?

Contact MaxNet Homes for a fair cash offer today.

How long does it take to get a building permit in Los Angeles?

Small projects: 2–4 weeks

Large or complex projects: Several months

Factors: Plan check, approvals, zoning reviews

Looking to sell your Los Angeles house fast without the hassle?

Contact MaxNet Homes for a quick cash offer today.

Are LA property records public?

Yes, they are public

Search through the Los Angeles County Registrar-Recorder’s office

Some records are available online for free

Need to sell your Los Angeles house fast?

Contact MaxNet Homes for a quick cash offer today.

Seller Credits Explained: 4 Ways Los Angeles Home Sellers Can Close Faster

Selling a home in Los Angeles today often means facing sky‐high prices and tight buyer budgets. For example, the median L.A. home recently hovered around the high-$700Ks to low-$800Ks, and only about 20% of California households can afford that . With mortgage rates up near 6–7%, many buyers can qualify for a loan but lack the extra cash for closing fees or repairs. That’s where a seller credit comes in – essentially a cash concession at closing to sweeten the deal. As Tricia Watts (founder of MaxNet Homes) emphasizes, LA sellers can use credits to bridge gaps without cutting their asking .

A seller credit (a type of seller concession) is simply money the seller gives the buyer at closing to help pay . It shows up on the settlement statement as a credit to the buyer – often offsetting closing costs like escrow, title insurance, lender fees, or even prepaid interest. (Closing costs usually run 2–5% of the purchase .) Seller credits can also cover repair costs identified in inspection, or other buyer expenses. In short, the seller is handing the buyer cash to cover part of the deal so the sale can close .

Why Los Angeles Sellers Use Credits

Seller credits aren’t automatic – they depend on market conditions and motivation. In a hot seller’s market, seller credits are less common. But when the market slows, or a seller needs a quick sale, credits become powerful . In Los Angeles, homes are taking about 45 days on market (vs. ~39 last year), so buyers have more choices and may ask for concessions. High prices mean even approved buyers may be cash-strapped by closing: only 1 in 5 Californians can afford the median . In this climate, savvy sellers use credits to attract qualified buyers.

Tricia Watts of MaxNet Homes notes that sellers who must sell quickly – due to a job move, inheritance, or looming foreclosure – often use credits strategically. For example, a seller who needs out but doesn’t want to drop their price might offer a credit instead (so the seller still nets the same sale proceeds). Roughly one-quarter of sellers nationally offered incentives like credits in , typically when they needed to compete or close the deal faster. Credits let sellers keep their original price intact while giving buyers relief on their out-of-pocket costs.

1. Repair Credits After Inspection

A common scenario: the home inspection reveals needed work (e.g. a leaky roof or termite damage). Instead of delaying closing to make repairs, the seller can promise a repair credit at closing. In practice, the contract states “seller to credit buyer $X at closing for repairs.” This gives the buyer cash to fix the issue themselves after closing. The benefit is mutual: the seller can close on schedule (and move out) without coordinating repairs, and the buyer gets the needed funds without walking away from the contract. For example, if a contractor estimates $5,000 to fix foundation cracks, the seller might simply credit $5,000 at closing.

How it works: Buyer flags an issue in inspection. Seller agrees on an equivalent credit amount (instead of fixing it). At closing, the amount is applied to the buyer’s costs or refunded.

Why use it: Keeps the sale alive without delay. The seller still nets the same funds, and the buyer can hire their own contractor.

Important: The credit can cover the repair cost, but if the fix is major, buyers should confirm the home’s appraised value still holds.

2. Closing-Cost Credits

If buyers qualify for a mortgage but are short on ready cash, sellers can offer credits toward closing costs. These costs include lender fees, escrow/title fees, and prepaid taxes/insurance – often 2–5% of the loan . A seller credit can pay part or all of these. For example, a home priced at $500,000 with 3% closing costs means $15,000 at closing. The seller might agree to a $10,000 credit so the buyer only needs $5,000 more in cash.

One twist: sellers can even raise the sale price and credit the difference so the seller still nets the same. For example, suppose you want to net $500,000 but the buyer can only bring $480,000 to close. You could list at $510,000 and credit $10,000 at closing. The seller still walks away with $500,000, while the buyer rolls that $10,000 into their loan. As one guide explains: “You raise the list price of your home so that the buyer can roll closing costs into the mortgage, while offering seller credits to apply toward those costs so they don’t have to come up with more cash”. In effect, both sides get what they need.

Listing sweetener: You can advertise “up to $X seller credit” in the MLS to attract “on-the-fence” buyers without lowering your list .

Loan structure: The buyer must still qualify for the larger loan amount, and the home must appraise at the higher price.

Net effect: Technically, a seller credit does not change your net proceeds (buyer pays the same total). But it does reduce the buyer’s required cash-to-close, making your home more affordable up front.

3. Interest-Rate Buy-Down Credits

Another way to use seller credit is to lower the buyer’s mortgage rate. Instead of giving the buyer cash at closing, the seller gives the equivalent amount to buy discount points. For instance, a $3,000 credit might pay one point (1% of loan) to reduce the interest rate by roughly 0.25%. This “buy-down” can save the buyer hundreds each month. It’s a smart use of credit in a high-rate market.

Be mindful of lender rules: lenders limit how much credit you can give, and what it can be used for. For conventional loans, Fannie Mae allows seller concessions up to 3%–9% of price (depending on down payment). FHA loans cap seller credit at 6% (and it can only cover approved costs like rate buydowns, discount points or closing fees). VA loans allow 4% (and generally exclude mortgage points). Crucially, no loan program allows seller credits to be used as the buyer’s down payment – that must come entirely from the .

4. Sweetener Credits (Home Warranty, HOA Fees, etc.)

Seller credits aren’t limited to repairs and closings. They can cover extra perks that make a home more appealing. For example, home warranties or insurance: if a seller plans to provide a one-year home warranty, they might credit its cost to the buyer instead of paying an insurer directly. One real estate guide notes: “Rather than directly paying for a [home warranty], you offer the buyer a seller credit of equivalent value at closing”. The buyer still gets the warranty protection, but the seller avoids setting up the policy – it’s just a credit adjustment on the closing statement. Similarly, a seller could credit costs for flood insurance or HOA transfer fees if those help close a deal.

Another “sweetener” is to include credit without reducing list price. If your home has sat on market, you might edit the listing to say “$X seller credit at closing.” As one example puts it, this signals to buyers you’re “not budging on list price, but willing to help offset costs a bit”. It’s a way to spark new interest without spooking buyers into thinking you’ve cut the price.

Home warranty credit: Can give buyers peace of mind on major systems.

Prepaid items: Credit for property taxes or insurance premiums can be offered.

Finishing funds: In some cases (new construction, FHA/VA buyers), sellers offer credits to let buyers pay private mortgage insurance (PMI) or other lender-required items.

Seller Credit vs. Price Reduction

Many sellers wonder whether to lower the price or offer a credit. On paper, a $5,000 price cut vs. a $5,000 credit net the seller the same proceeds. But the difference is in fees and taxes. Because commissions, transfer taxes and some fees are based on the sale price, keeping the price higher can cost the seller more. For example, at a 3% commission rate, a 3% drop on a $250,000 sale saves $150 in . Top real estate agents generally advise: if you must give away value, it’s often better to lower the sale price than to offer a credit. As one California agent explains, “If all things are equal on the offers, it’s generally in the seller’s best interest to accept an offer with a lower price than a higher price and a closing costs credit”. In short, credits benefit buyers more (they save at closing), while price reductions benefit sellers by reducing fees.

How to Negotiate Seller Credits

If you decide a credit makes sense, it should be spelled out clearly in the contract. Typical phrasing in a purchase agreement or MLS listing might read, “Seller to credit Buyer $X at closing for [closing costs/repairs/etc.].” In California, it often appears under “seller concessions” or “closing cost credits.” Agents can write it as a flat dollar amount or a percentage of the price. Keep your listing price firm, and use the credit as the incentive. Here are some tips:

Mention it in the listing: E.g. “Seller will credit $5,000 toward buyer’s closing costs.” This can draw attention without advertising a price cut.

Be specific: In the contract, state the exact dollar amount or clearly define the credit (percent of price) and purpose (e.g. “for lender fees”).

Limit it: Only offer what you can afford. Remember lender caps (e.g. 3–9% conventional, 6% FHA).

Time the credit: You could offer a credit contingently (if buyer uses certain lender) or unconditionally. Work with your agent to structure it.

Ultimately, seller credits are just one tool – use them when they help the deal without hurting your bottom line. Tricia Watts reminds LA sellers that transparency and fairness build trust: if you show credit as part of an otherwise solid offer, buyers see you’re serious about .

Frequently Asked Questions

What is a seller credit?

It’s money the seller agrees to give the buyer at closing, to cover costs or . You’ll see it on the closing statement as a credit to the buyer’s side. It’s a form of seller concession (just one type of credit).How can seller credits be used?

Common uses include paying a buyer’s closing fees, funding agreed repairs, buying down the mortgage rate, or covering extras like a home warranty. Essentially any approved closing expense can be credited.Can I use seller credit for my down payment?

No. Lenders do not allow seller credits toward the buyer’s down payment. Credits can only cover lender-approved costs (interest buydowns, discount points, closing costs).Does a seller credit reduce the sale price?

No – the sale price stays the same. A credit is extra money from the seller on top of the price. That said, a credit functionally gives the buyer the same net cost as a price reduction, but affecting fees differently (see above).What’s the difference between seller credit and seller concession?

“Seller concession” is a broad term for anything the seller agrees to pay on behalf of the buyer (repairs, fees, points). A “seller credit” specifically means a cash credit on the closing statement (one kind of concession).What is a seller credit on a closing statement?

It’s listed as a negative charge (credit) to the buyer, often under “seller credits” or “closing cost credits.” It reduces the buyer’s cash-to-close.

Selling Options with MaxNet Homes

Thinking all these negotiations sound stressful? In Los Angeles, many sellers opt for a fast cash sale instead. Cash home buyers like MaxNet Homes (founded by Tricia Watts) offer straightforward, all-cash offers with no agent commissions or hidden . For homeowners needing speed and certainty, this can outpace any seller credit arrangement.

MaxNet Homes streamlines the process into 5 simple steps: you fill out an online quote, they inspect your house (as-is), then deliver an instant cash offer. If you accept, you choose the closing date, sign paperwork, and get paid – often in a matter of . This no-hassle path avoids loan approvals and lengthy lender red tape. In fact, it’s not unusual for L.A. sellers to close in 7–10 days with a cash . MaxNet highlights that benefit prominently – you could “Close in 7 Days” with no fees – giving you cash on hand almost immediately.

When working with any cash buyer, Tricia advises choosing a reputable local company. Look for strong reviews, plenty of experience, and even BBB . MaxNet Homes meets those criteria: it’s BBB-accredited and focuses on transparency and empathy, treating you with respect throughout the . As MaxNet emphasizes, their offers are 100% no-obligation. You can “get started by contacting MaxNet Homes today to request a free quote and see how much cash your home could sell for”.

Whether you decide to offer a seller credit or take a direct cash offer, the goal is the same: a smooth, fair sale on your terms. As the market evolves, tools like seller credits – and alternatives like quick cash offers from trusted buyers – give Los Angeles homeowners options to close the deal with .

Need to sell fast? Contact MaxNet Homes (Tricia Watts) today for a no-pressure cash offer on your Los Angeles .

Sources: Authoritative real estate guides and industry data were used to explain seller credit rules and . These sources reflect current 2025 market insights and lending limits.

The Best Way To Sell Your House Quickly

Stuck in foreclosure? Facing a messy divorce? Liens against the title? Probate? MaxNet Homes helps property owners all over Los Angeles and other parts of CA sell their homes fast.

There’s no issue we haven’t dealt with! We’ve helped homeowners who own vacant property, have a house about to go to auction, are stuck with a hoarder inheritance, retiring and want to downsize, and more. Call us today and let’s work together to find a solution to whatever situation you might be facing.

We buy houses in CA, including Los Angeles and the surrounding area, for a competitive cash price on a schedule that works for you. Since we also operate as traditional real estate agents, our knowledge and experience of the local market means that we can help you get top dollar for your house through a traditional home sale. If you’re looking to maximize the amount you can get for your house, we will partner with you to list your Los Angeles, CA house to sell it for top dollar.

To start, let us know about the property you’re ready to see in your rearview mirror. Let us know if you would like to sell that unwanted house or rental property for a competitive cash price fast or work with us to get the most money possible with a traditional home sale.

We buy houses in Los Angeles and all surrounding areas in CA. If you need to sell your house fast, connect with us today. We would love to make you a no-obligation cash offer that is hassle-free. 🙂

Call us today at 1 844-MAXNET-8